Latest News

Via Benzinga · January 19, 2026

Dividend-growth and high-yield strategies can produce very different portfolios and results, but one strategy looks better right now.

Via The Motley Fool · January 19, 2026

The S&P 500 has stormed into 2026 with unprecedented momentum, shattering all-time records and cementing one of the most powerful bull markets in modern financial history. As of January 19, 2026, the index is trading near the 6,900 mark, having reached a historic peak of 6,945 earlier

Via MarketMinute · January 19, 2026

Retirees in This State Could Keep More of Their Social Security Benefits in 2026fool.com

A recent law change will give residents one less expense to worry about this year.

Via The Motley Fool · January 19, 2026

Coinbase (NASDAQ:COIN) CEO Brian Armstrong has withdrawn support for the proposed Crypto Clarity Act, citing fundamental flaws in the legislation.

Via Benzinga · January 19, 2026

NEW YORK — As the first major earnings season of 2026 gets underway, a startling reality has emerged across trading floors: the widely predicted "margin collapse" from the 2025 trade escalations has failed to materialize. Despite an effective U.S. tariff rate that peaked at a staggering 17% in late 2025,

Via MarketMinute · January 19, 2026

Via Benzinga · January 19, 2026

This article analyzes the WSJ Economic Survey, comparing mean GDP forecasts against CBO projections and Goldman Sachs tracking. The data visualizes the 2026 trajectory, showing how current growth trends align with long-term expectations.

Via Talk Markets · January 19, 2026

Via Benzinga · January 19, 2026

Trump's tariff war with Europe isn't what you think it is—and it's about to backfire spectacularly.

Via Talk Markets · January 19, 2026

The United States labor market has transitioned into a state of "strategic hibernation," marked by a "no hiring, no firing" equilibrium that has left economists and investors recalibrating their expectations for the year ahead. Following the release of the December 2025 jobs report, it is clear that the frenetic churn

Via MarketMinute · January 19, 2026

As the 2026 fiscal year begins to unfold, a dramatic shift in global energy markets is emerging as the unexpected hero for the American corporate bottom line. Following a period of stubborn inflationary pressures and volatile energy costs, a persistent global supply surplus has sent crude oil prices tumbling, providing

Via MarketMinute · January 19, 2026

The global financial landscape as of January 19, 2026, is witnessing a dramatic reallocation of capital. Investors are rapidly rotating out of the once-favored financial services sector and into consumer defensive stocks, commonly known as consumer staples. This shift follows a period of heightened regulatory volatility and a cooling consumer

Via MarketMinute · January 19, 2026

The U.S. bond market reached a significant technical and psychological milestone this week as the yield on the benchmark 10-year Treasury note slipped below the 4.15% threshold for the first time in months. As of January 19, 2026, the yield is hovering at 4.14%, a move that

Via MarketMinute · January 19, 2026

As of January 19, 2026, the landscape of American finance looks fundamentally different than it did just two years ago. The once-fringe world of prediction markets has exploded into a mainstream powerhouse, driven by a radical shift in federal oversight. What began as a high-stakes legal battle between Kalshi and the Commodity Futures Trading Commission [...]

Via PredictStreet · January 19, 2026

As Wall Street observes Martin Luther King Jr. Day and U.S. cash markets remain closed, the prevailing narrative of the 2026 fiscal year has become impossible to ignore: the "Great Convergence." For the first time in over three years, the staggering earnings gap between the so-called "Magnificent Seven" and

Via MarketMinute · January 19, 2026

The 2024 U.S. Presidential election served as a high-stakes laboratory for the burgeoning world of prediction markets, pitting established academic platforms against crypto-native giants and regulated newcomers. As of January 19, 2026, the dust has finally settled on the post-election post-mortems, revealing a surprising "Accuracy War" where the most liquid markets weren’t necessarily the most [...]

Via PredictStreet · January 19, 2026

XRP risks being squeezed out of a competitive global payment space.

Via The Motley Fool · January 19, 2026

In a move that has ignited a firestorm of constitutional and economic debate, the Department of Justice (DOJ) under the Trump administration has officially launched a criminal investigation into Federal Reserve Chair Jerome Powell. The escalation, characterized by many on Wall Street as a frontal assault on the independence of

Via MarketMinute · January 19, 2026

As of mid-January 2026, the global financial landscape is witnessing a profound shift in how risk is priced and managed. Long dismissed as the domain of political junkies and speculators, prediction markets have officially entered the "Institutional Era." This morning, January 19, 2026, trading desks at major investment banks are no longer just looking at [...]

Via PredictStreet · January 19, 2026

As of January 19, 2026, the global financial landscape is increasingly dominated by a controversial new asset class: geopolitical instability. Following the chaotic start to the year—marked by the capture of Nicolás Maduro in Venezuela on January 3 and a subsequent hypersonic missile test by Pyongyang on January 4—prediction markets have seen an unprecedented surge [...]

Via PredictStreet · January 19, 2026

Via Benzinga · January 19, 2026

Stocks sold off, and gold hit a new record as trade tensions between the US and Europe erupted over Trump’s push to take control of Greenland.

Via Talk Markets · January 19, 2026

As the first month of 2026 reaches its crescendo, a high-stakes financial battle is playing out not just on the trading floors of Wall Street, but in the digital arenas of prediction markets. On Polymarket, the world’s largest decentralized prediction platform, a market titled "Largest Company by Market Cap at end of January?" has surpassed [...]

Via PredictStreet · January 19, 2026

These energy stocks have ample fuel to continue increasing their high-yielding payouts.

Via The Motley Fool · January 19, 2026

As of January 2026, the image of the "professional trader" has undergone a radical transformation. Gone are the days when high-stakes finance was solely the province of Wall Street floor traders or quantitative hedge fund analysts staring at Bloomberg terminals. Today, the new face of alpha is Logan Sudeith, a 25-year-old former risk analyst from [...]

Via PredictStreet · January 19, 2026

CHICAGO — January 19, 2026 — In a historic session for commodities, gold and silver futures have rocketed to fresh all-time highs, marking a seismic shift in global asset allocation. As of midday trading, gold futures for February delivery surged to a staggering $4,689.39 per ounce, while silver futures broke

Via MarketMinute · January 19, 2026

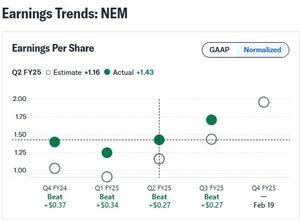

Newmont, one of the early reporters, is scheduled to release its results on February 19.

Via Talk Markets · January 19, 2026

As of mid-January 2026, the meteoric rise of prediction markets has hit a formidable regulatory wall. Kalshi, the federally regulated exchange that pioneered event contracts in the U.S., is currently locked in a high-stakes legal standoff with several powerful state regulators. The conflict has reached a boiling point in Massachusetts, where a state court is [...]

Via PredictStreet · January 19, 2026

In a week defined by escalating geopolitical friction and renewed economic uncertainty, the energy sector has emerged as a formidable bastion for investors. While the broader S&P 500 (NYSEARCA: SPY) struggled under the weight of fresh trade tensions and concerns over central bank independence, the S&P 500 Energy

Via MarketMinute · January 19, 2026

In a surprising display of late-year momentum, U.S. retail sales rose by 0.6% in November 2025, handily beating the 0.4% growth forecasted by Wall Street economists. The data, released by the Commerce Department on January 14, 2026, after a significant delay caused by a 43-day federal government

Via MarketMinute · January 19, 2026

On January 7, 2026, a tectonic shift occurred in the landscape of global media. Dow Jones & Co. (NASDAQ: NWSA), the parent company of The Wall Street Journal, announced an exclusive multi-year partnership with Polymarket, the world’s largest decentralized prediction market. This deal formally integrates real-time, blockchain-based prediction data across the Dow Jones consumer ecosystem, [...]

Via PredictStreet · January 19, 2026

The latest Producer Price Index (PPI) report for November 2025 has provided a rare glimmer of hope for a cooling economy, as wholesale prices rose by just 0.2%, undershooting the 0.3% increase forecast by Wall Street economists. This data, released by the Bureau of Labor Statistics (BLS) on

Via MarketMinute · January 19, 2026

In the hyper-volatile world of decentralized prediction markets, "alpha"—the industry term for an information edge—is everything. But on the evening of January 2, 2026, a single trader on Polymarket appeared to possess an edge so sharp it cut through the fog of international diplomacy. Just hours before U.S. Special Forces descended on Caracas in a [...]

Via PredictStreet · January 19, 2026

WASHINGTON D.C. — In a series of sweeping policy declarations that have sent shockwaves through the financial corridors of Wall Street, President Trump has set the stage for a radical restructuring of the American credit system. As of January 19, 2026, the administration has doubled down on its pledge to

Via MarketMinute · January 19, 2026

NEW YORK — The third week of January 2026 has proven to be a sobering reality check for the U.S. financial sector. As of Monday, January 19, 2026, investors are still parsing a turbulent week that saw billions in market capitalization evaporated from the nation’s largest lenders. A volatile

Via MarketMinute · January 19, 2026

Prediction markets have officially crossed the rubicon into the financial mainstream. In a staggering display of market maturity, the sector recorded an all-time high weekly volume of $3.7 billion during the second week of January 2026. This surge was punctuated by a single-day trading peak of $701.7 million, signaling that "event-based trading" is no longer [...]

Via PredictStreet · January 19, 2026

Ripple's role is evolving alongside the United States' shift from regulation by enforcement to regulation by legislation, a transition that could keep XRP (CRYPTO: XRP)

Via Benzinga · January 19, 2026

Via Benzinga · January 19, 2026

Via MarketBeat · January 19, 2026

Once politics stop interfering, investment will thrive. If you want respect for the environment, economic development, and sustainability, you should trust engineers, not politicians.

Via Talk Markets · January 19, 2026

This stock provides investors something that no precious metal can provide.

Via The Motley Fool · January 19, 2026

Via Benzinga · January 19, 2026

Indian gold demand has remained resilient, despite record-high prices, driven by strong investment demand. India ranks as the world’s second-largest gold market.

Via Talk Markets · January 19, 2026

Cable trended lower last week, despite better-than-anticipated monthly GDP figures.

Via Talk Markets · January 19, 2026

All three of these healthcare giants are leaders in their niches.

Via The Motley Fool · January 19, 2026

Block is ready to unveil its fiscal fourth-quarter earnings soon, and analysts project earnings in line with the year-ago quarter.

Via Barchart.com · January 19, 2026