Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

With risk assets retreating and commodities exploding higher, investors are hunting for durable growth stories trading below consensus value.

Via Talk Markets · January 20, 2026

The GBP/USD outlook turns bullish despite mixed UK labor market data.

Via Talk Markets · January 20, 2026

Although the benchmark indices opened flat, they traded negatively throughout the session and ultimately closed red.

Via Talk Markets · January 20, 2026

Silver charted its fifth consecutive structural market deficit in 2025 based on preliminary analysis of the data. The shortfall will likely exacerbate tight supply issues that have precipitated a significant silver squeeze.

Via Talk Markets · January 20, 2026

From a technical analysis point of view, the trend remains firmly bullish.

Via Talk Markets · January 20, 2026

After closing out the preceding week at a record high, the S&P 500 clocked a new record high close of 6,977.27 on Monday, 12 January 2026 before retreating a half percent to end the week at 6,940.01, about 0.4% below its previous week's close.

Via Talk Markets · January 20, 2026

Global markets head into the North American open with the dollar under pressure and risk sentiment fragile.

Via Talk Markets · January 20, 2026

USD/CAD price analysis remains under selling pressure as oil prices remain stable while the dollar weakens.

Via Talk Markets · January 20, 2026

EUR/USD continues to face strong bearish pressure as traders react to escalating EU-US tensions and Fed rate outlooks, with 1.1500 emerging as a key support level.

Via Talk Markets · January 20, 2026

The markets are reacting dramatically to recent developments. Stocks and bonds have been sold, gold and silver are at record highs, and the US dollar has been sold aggressively.

Via Talk Markets · January 20, 2026

Johnson & Johnson's stock approaches its 52-week high due to positive Phase 3 CAPLYTA trial data, strong earnings momentum, and favorable market sentiment as it nears an upcoming earnings report.

Via Talk Markets · January 20, 2026

D.R. Horton beat Wall Street estimates in Q1 fiscal 2026 as earnings rose to $2.03 per share and revenue came in at $6.9 billion, while maintaining its outlook for 2026.

Via Talk Markets · January 20, 2026

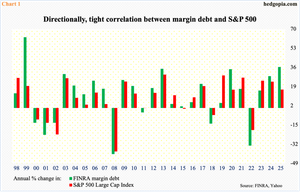

Amidst households’ equity allocation at a fresh record and continued support from margin debt, large-cap indices are giving out signs of fatigue.

Via Talk Markets · January 20, 2026

The Euro dropped to 1.1578 so far today.

Via Talk Markets · January 20, 2026

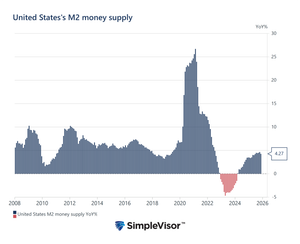

Supporting the dollar-debasement narrative is the claim that money supply growth is out of control.

Via Talk Markets · January 20, 2026

Rising global yields, political risk, and escalating trade frictions are creating a fragile macro backdrop for investors heading into the new day.

Via Talk Markets · January 20, 2026

European markets continue to lose traction, as faltering relations with the US point towards a difficult path forward for Nato.

Via Talk Markets · January 20, 2026

The Euro rallied quite nicely during the trading session on Monday as the United States was closed for Martin Luther King Jr Day. The real momentum could be seen on Tuesday.

Via Talk Markets · January 20, 2026

Bank of England officials – or some of them at least – remain concerned about inflation.

Via Talk Markets · January 20, 2026

Gold surges to another record above $4,700 as geopolitical and trade tensions fuel demand for defensive assets.

Via Talk Markets · January 20, 2026

3M posted a Q4 earnings and revenue beat, delivering $1.83 adjusted EPS and $6.1 billion in sales, while forecasting growth in 2026.

Via Talk Markets · January 20, 2026

DAX slumps for a third day as Trump’s tariff threats weigh. GBP/USD rises on USD weakness & despite soft UK jobs data.

Via Talk Markets · January 20, 2026

Recently, VistaShares launched a couple of ETFs that offer high yields and aim to track returns from famous hedge funds.

Via Talk Markets · January 19, 2026

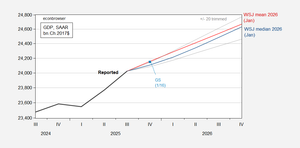

While the mean forecast is for around 2.2% growth in 2026, the trimmed 20% band suggests some downside risks.

Via Talk Markets · January 19, 2026

The US natural gas prices jumped more than 17% to $3.65 per MMBtu, sharply rebounding from a 13-week low of $3.10 recorded last week.

Via Talk Markets · January 20, 2026

Global markets faced further turbulence as Treasuries joined a widespread bond sell-off and equities took a hit.

Via Talk Markets · January 20, 2026

The Pound Sterling attracts significant bids against its currency peers after mixed UK employment data.

Via Talk Markets · January 20, 2026

The EUR/USD pair remains below key resistance as geopolitical tensions and bearish technicals increase the likelihood of a drop toward 1.1500.

Via Talk Markets · January 20, 2026

Most investment firms kick off the new year with “outlook” pieces, offering futile predictions on the S&P 500’s year-end close or the frequency of Fed rate hikes.

Via Talk Markets · January 20, 2026

Chinese retail sales just did something they’ve never done before outside of the lockdowns.

Via Talk Markets · January 20, 2026

Bitcoin continues to attract buyers on dips, holding firm near the 50-day EMA as broader market volatility fails to derail its long-term bullish outlook.

Via Talk Markets · January 20, 2026

Asian markets traded lower Tuesday as President Donald Trump's tariff threats over Greenland stoked concerns of revived trade tensions and weighed on investors' risk appetite.

Via Talk Markets · January 20, 2026

The re-opening of US markets has seen the dollar edge a little lower.

Via Talk Markets · January 20, 2026

The Dow inched lower amid spooked markets over another trade conflict.

Via Talk Markets · January 20, 2026

The cryptocurrency market has continued its poor start to the week as Bitcoin has dropped below the $91k level. The leading cryptocurrency is down 1.6% in the last 24 hours and is now trading at $90,940.

Via Talk Markets · January 20, 2026

Dow Jones futures decline as sentiment weakened amid rising uncertainty over the US–Greenland issue.

Via Talk Markets · January 20, 2026

There is too much oil supply and rising inventories, but on the other hand, extra price is built into oil because traders are worried about Iran supply disruption, even if it hasn't happened yet.

Via Talk Markets · January 20, 2026

As of 2026, China has reportedly secured dominance over the silver market, leveraging a historic 300 Moz Fed loan and vault acquisitions to control supply. With COMEX facing a major delivery default, a systemic crisis looms.

Via Talk Markets · January 20, 2026

The USD/CAD pair trades 0.13% lower to near 1.3850 during the early European trading session on Tuesday.

Via Talk Markets · January 20, 2026

After January’s options expiration last Friday, we have a mild seasonally weak patch over the coming four days. I expect that index to see new highs before long.

Via Talk Markets · January 20, 2026

EURJPY moves higher and hits 5R target at 184.42 where I closed 1/2 the position for +2.5% profit gain.

Via Talk Markets · January 20, 2026

Netflix stock is down 6% in the first 11 trading days of 2026, with markets closed on Monday in observance of Martin Luther King Day.

Via Talk Markets · January 19, 2026

The Japanese Yen (JPY) attracts some dip-buying during the Asian session on Tuesday and stalls the previous day's retracement slide from a one-week high against its American counterpart.

Via Talk Markets · January 19, 2026

Our new trading week does not begin until Tuesday, when we will also resume Q4 earnings season starting ahead of the opening bell. Today, the market is closed to commemorate the birthday of Rev. Dr. Martin Luther King, Jr.

Via Talk Markets · January 19, 2026

Silver price attracts some sellers to around $93.60 during the Asian trading hours on Tuesday. The white metal edges lower amid some profit taking after reaching a fresh record high in the previous session.

Via Talk Markets · January 19, 2026

While most stocks pay quarterly dividends, investors can still construct a portfolio that allows them to get paid monthly. How? Let me explain...

Via Talk Markets · January 19, 2026

Commodities performed relatively well yesterday despite the escalation in tensions between the US and EU as a weaker USD proved supportive

Via Talk Markets · January 19, 2026

Physical metal demand is skyrocketing as central banks and elites hedge against geopolitical conflict, stagflation, and Fed policy.

Via Talk Markets · January 19, 2026

Goolsbee’s dismissal of labor market weakness highlights a growing rift inside the Fed, complicating the path to rate cuts.

Via Talk Markets · January 19, 2026

Retail investors have a less diversified portfolio than institutions.

Via Talk Markets · January 19, 2026

As investment bubbles grow, global power shifts accelerate, and geopolitical tensions rise, the world may be heading toward a far more unstable decade than markets currently price in.

Via Talk Markets · January 19, 2026

The right options trading mindset is critical to success. Be prepared for whatever comes next, let go of trading mistakes, and cultivate a short-term memory.

Via Talk Markets · January 19, 2026

European capitals are weighing their response to President Donald Trump’s latest tariff threat, this time tied to his controversial push to acquire Greenland.

Via Talk Markets · January 19, 2026

Government inflates through its central bank, the Federal Reserve System. The Fed does many other things, but its foremost responsibility is to support favored market actors through a convoluted process of monetary inflation.

Via Talk Markets · January 19, 2026

Here’s why the struggle between the White House and the Federal Reserve offers a bullish signal for gold.

Via Talk Markets · January 19, 2026

Via Talk Markets · January 19, 2026

The aggressive dual upgrades have reignited optimism around the memory chip maker, but the real question is whether a forward P/E of 12 times already prices in the upside.

Via Talk Markets · January 19, 2026

The January Effect is the historical tendency for stock prices, especially small-cap stocks, to rise in the first month of the new year due to depressed prices from heavy selling in the previous month of December.

Via Talk Markets · January 19, 2026

With 2026 just getting underway there isn't a shortage of forecast letters and commentary on expectations for the coming year.

Via Talk Markets · January 19, 2026

Shorting out-of-the-money OXY puts over the next month provides almost a 1.5% yield.

Via Talk Markets · January 19, 2026

The U.S. markets are closed today, but gold and silver clearly didn’t get the memo.

Via Talk Markets · January 19, 2026

Bitcoin may be experiencing a short-term profit-taking pressure after its recent rally to new multi-week highs, but the rally looks set to continue, driven by U.S. macro conditions.

Via Talk Markets · January 19, 2026

For investors, Caterpillar shares’ exposure to AI-driven energy demand adds a “fresh” layer to its traditional construction and mining narrative.

Via Talk Markets · January 19, 2026

Over extended market cycles, Israel’s mid-cap equities have often delivered strong growth, driven by their greater sensitivity to domestic economic trends.

Via Talk Markets · January 19, 2026

Favorable quarterly results from the big U.S. banks sparked the Q4 earnings season off to a good start this week, and were complemented by very strong reports from the top investment management firms.

Via Talk Markets · January 19, 2026

XRP holds above Ichimoku Cloud against Ethereum, triggering a rare bullish signal after years of resistance on the two-week chart.

Via Talk Markets · January 19, 2026

GBP/USD rises on Monday after tensions between the US and Europe had grown following a social media post of US President Donald Trump threatening to impose duties on eight European countries.

Via Talk Markets · January 19, 2026

Despite claims that tariffs force foreign companies to pay, the data reveal a different story. Consumers at home are carrying the weight.

Via Talk Markets · January 19, 2026

The FTSE 100, a key index for blue-chip stocks, fell by 0.5%, while the mid-cap FTSE 250, which tracks domestic companies, plunged 0.9%—its steepest one-day drop since late November.

Via Talk Markets · January 19, 2026

The semiconductor trade in 2026 is tilting toward CPUs, as inferencing demand reshapes the supply chain. “It’s CPUs this year versus GPUs last year,” T. Rowe Price analyst told CNBC in an interview today.

Via Talk Markets · January 19, 2026

U.S. natural gas prices have soared nearly 10% to $3.41/MMBtu, fueled by a burst of chilly late-January weather that’s driving up heating demand.

Via Talk Markets · January 19, 2026

This article analyzes the WSJ Economic Survey, comparing mean GDP forecasts against CBO projections and Goldman Sachs tracking. The data visualizes the 2026 trajectory, showing how current growth trends align with long-term expectations.

Via Talk Markets · January 19, 2026

Trump's tariff war with Europe isn't what you think it is—and it's about to backfire spectacularly.

Via Talk Markets · January 19, 2026

Stocks sold off, and gold hit a new record as trade tensions between the US and Europe erupted over Trump’s push to take control of Greenland.

Via Talk Markets · January 19, 2026

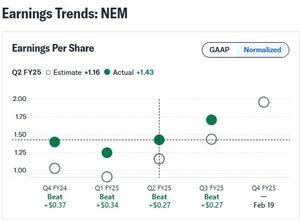

Newmont, one of the early reporters, is scheduled to release its results on February 19.

Via Talk Markets · January 19, 2026