JPMorgan Chase & Co (JPM)

302.74

-9.73 (-3.11%)

NYSE · Last Trade: Jan 21st, 1:02 AM EST

Goldman Sachs stock surged over the last year, and could continue to climb higher in 2026.

Via The Motley Fool · January 20, 2026

As the global financial markets navigate the opening weeks of 2026, a massive structural shift has taken hold of the commodities sector. Industrial and precious metals are currently undergoing a historic price surge, with gold, silver, and copper all testing psychological and technical ceilings that were once thought unreachable. This

Via MarketMinute · January 20, 2026

As the clock ticks toward the end of January 2026, Wall Street is laser-focused on a single number: the Personal Consumption Expenditures (PCE) price index. With the current date of January 20, 2026, the financial world is bracing for a critical update that has been complicated by recent government administrative

Via MarketMinute · January 20, 2026

As the global financial community turns its attention to the fast-approaching release of the February ADP National Employment Report, the stakes for the Federal Reserve’s monetary policy have rarely been higher. Following a volatile finish to 2025 and a strategic pause in the central bank's rate-cutting cycle in January,

Via MarketMinute · January 20, 2026

The long-standing wall between the White House and the Federal Reserve has been breached as of January 20, 2026, following an unprecedented criminal investigation launched by the Department of Justice (DOJ) into Federal Reserve Chairman Jerome Powell. The investigation, which centers on alleged misinformation regarding a $2.5 billion renovation

Via MarketMinute · January 20, 2026

The global financial landscape was upended this weekend as the Trump administration unveiled a radical new trade offensive, dubbed the “Greenland Tax,” aimed at coercing the Kingdom of Denmark into negotiating the sale of the world's largest island. In a surprise announcement on Saturday, January 17, 2026, President Trump declared

Via MarketMinute · January 20, 2026

In a historic display of financial gravity, BlackRock (NYSE: BLK) has officially crossed the $14 trillion mark in assets under management (AUM), solidifying its position as the undisputed heavyweight champion of the global investment landscape. According to its Q4 2025 earnings report released on January 15, 2026, the firm ended

Via MarketMinute · January 20, 2026

On January 15, 2026, Morgan Stanley (NYSE: MS) released a blockbuster fourth-quarter and full-year 2025 earnings report that has sent a clear message to Wall Street: the firm’s decade-long pivot toward wealth management has created a virtually impenetrable "compounding machine." By successfully balancing the high-octane, often volatile world of

Via MarketMinute · January 20, 2026

As the sun rose over Manhattan on January 20, 2026, the financial district found itself navigating a paradoxical landscape of geopolitical tension and unprecedented corporate consolidation. Goldman Sachs (NYSE: GS), the storied titan of investment banking, has effectively declared the "dealmaking winter" over, posting a blockbuster fourth-quarter and full-year 2025

Via MarketMinute · January 20, 2026

Is it finally time to bet on flying electric taxis?

Via The Motley Fool · January 20, 2026

Novo and Aspect have been collaborating since 2023 to develop cellular medicines, and said that the new partnership phase builds on the momentum achieved in the existing collaboration.

Via Stocktwits · January 20, 2026

As the dust settles on the fourth-quarter earnings season of 2025, the financial sector has emerged as the undisputed titan of the S&P 500. Surpassing even the high-flying technology sector, financial institutions have reported a staggering 55% earnings growth rate in key sub-sectors, marking a definitive end to the

Via MarketMinute · January 20, 2026

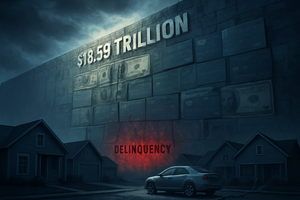

As of January 20, 2026, the American consumer is navigating a financial landscape defined by a staggering milestone: total household debt has officially surged past the $18 trillion mark, settling at a record $18.59 trillion. While the headline figure represents a massive expansion of credit, the underlying data reveals

Via MarketMinute · January 20, 2026

As the markets reopened following the Martin Luther King Jr. Day holiday on January 20, 2026, the financial world found itself gripped by a paradoxical tug-of-war. The yield on the US 10-year Treasury note—a global benchmark for borrowing costs—settled at 4.26%, a level that reflects a complex

Via MarketMinute · January 20, 2026

The American consumer is retreating into a defensive posture as the new year begins. The Conference Board announced today, January 20, 2026, that its Consumer Confidence Index fell to 98.3, an eight-month low that significantly missed economist expectations of 102.7. This decline reflects a deepening sense of unease

Via MarketMinute · January 20, 2026

In a bold move to tackle the persistent housing affordability crisis, the White House has issued a direct instruction to the Federal National Mortgage Association (OTC: FNMA), known as Fannie Mae, and the Federal Home Loan Mortgage Corp (OTC: FMCC), or Freddie Mac, to inject $200 billion into the mortgage-backed

Via MarketMinute · January 20, 2026

In a series of sobering assessments delivered during the mid-January earnings cycle, Jamie Dimon, the Chairman and CEO of JPMorgan Chase & Co. (NYSE: JPM), has issued a stark warning to investors: do not mistake the current economic "sunshine" for a permanent state of affairs. While acknowledging that the American consumer

Via MarketMinute · January 20, 2026

The latest inflation data for December has arrived with a sense of stability that offers both a sigh of relief and a note of caution for the Federal Reserve. Headline Consumer Price Index (CPI) remained at 2.7%, while the core figure—which excludes the often-volatile food and energy sectors—

Via MarketMinute · January 20, 2026

The mid-January earnings gauntlet has turned into a freezing reality for the titans of American finance. In the first three weeks of 2026, the "Big Four" US banks have collectively surrendered more than $50 billion in market capitalization, a staggering retreat driven by a perfect storm of legislative threats and

Via MarketMinute · January 20, 2026

In a move that has sent shockwaves through the financial sector and the corridors of Capitol Hill, President Donald Trump officially endorsed the Credit Card Competition Act (CCCA) on January 13, 2026. Characterizing the prevailing credit card "swipe fees" as a "hidden tax" and an "out-of-control ripoff" on the American

Via MarketMinute · January 20, 2026

As of January 20, 2026, a fundamental shift has occurred in the plumbing of global finance. For decades, the "tape"—the real-time feed of stock and bond prices—was the undisputed source of truth for traders. Today, that tape has a rival. Professional desks at major banks and hedge funds are increasingly turning to prediction markets like [...]

Via PredictStreet · January 20, 2026

As the Federal Reserve prepares for its first policy meeting of 2026 on January 27–28, a significant shift has occurred in how the financial world anticipates interest rate decisions. The traditional dominance of professional economic surveys and even standard bond-market derivatives is being challenged by prediction markets like Kalshi and Polymarket. For the upcoming January [...]

Via PredictStreet · January 20, 2026

In a move that has sent shockwaves through the global media and technology sectors, Electronic Arts (NASDAQ: EA) has officially entered the final stages of a $56.5 billion leveraged buyout (LBO). The deal, which was announced in late 2025 and is finalizing as of January 20, 2026, represents the

Via MarketMinute · January 20, 2026

The American consumer has once again defied gravity, as the U.S. Census Bureau’s delayed report on November retail sales showed a robust 0.6% increase, significantly outpacing the 0.4% gain projected by Wall Street. This surge, released on January 14, 2026, after a 43-day federal government shutdown

Via MarketMinute · January 20, 2026

As of January 20, 2026, the American financial landscape is facing a seismic shift as the White House’s proposed 10% cap on credit card interest rates moves from a campaign-trail firebrand to a looming regulatory reality. The mandate, which President Trump aggressively revived earlier this month, seeks to provide

Via MarketMinute · January 20, 2026