SPDR S&P 500 ETF Trust (SPY)

676.33

-0.85 (-0.13%)

NYSE · Last Trade: Mar 11th, 4:48 PM EDT

Detailed Quote

| Previous Close | 677.18 |

|---|---|

| Open | 677.58 |

| Day's Range | 673.34 - 680.08 |

| 52 Week Range | 69.00 - 697.84 |

| Volume | 67,051,719 |

| Market Cap | 7.17B |

| Dividend & Yield | 7.972 (1.18%) |

| 1 Month Average Volume | 84,747,788 |

Chart

News & Press Releases

MARCH 11, 2026 — In a striking divergence of global asset classes, Bitcoin (BTC) is once again hovering near the psychologically critical $70,000 mark, displaying remarkable resilience even as traditional equities face a bruising technical breakdown. As the S&P 500 (NYSE: SPY) yields to mounting pressure from deteriorating internal

Via MarketMinute · March 11, 2026

The multi-year bull market that defined the mid-2020s is facing its sternest test yet. On March 11, 2026, the S&P 500 index decisively breached the critical 6,764 support level, a technical floor that had anchored market optimism since the beginning of the year. This breakdown was accompanied by

Via MarketMinute · March 11, 2026

Market Breadth Deteriorates Again as Tuesday’s Rebound Attempt Fadeschartmill.com

Via Chartmill · March 11, 2026

Market Breadth Rebounds, But Internal Damage Still Runs Deepchartmill.com

Via Chartmill · March 10, 2026

The S&P 500 is off to an underwhelming start to 2026, and a troubling macroeconomic picture could make things worse.

Via The Motley Fool · March 11, 2026

Data from Stocktwits indicated that retail sentiment on SPY and QQQ reflects growing caution in the market.

Via Stocktwits · March 11, 2026

Oracle plans to introduce sales and marketing tools.

Via Stocktwits · March 11, 2026

Watcher count for PLYX on Stocktwits increased by nearly 50% in a single day.

Via Stocktwits · March 11, 2026

Oracle trains AI models and hosts enterprise data on its cloud; bringing the two together helps deliver highly capable AI services to its cloud customers.

Via Stocktwits · March 11, 2026

Schonfeld Strategic Advisors reduced its position in the iShares Ethereum Trust ETF during the fourth quarter. The fund holds ether directly and offers investors a simpler path to Ethereum exposure through a regulated exchange-traded structure, without the need to use crypto exchanges or manage digital wallets.

Via The Motley Fool · March 10, 2026

Investors are focused on Wednesday’s CPI report, with headline inflation expected to rise 2.4% from the previous year.

Via Stocktwits · March 10, 2026

The First Trust Capital Strength ETF tracks U.S. companies selected for profitability and balance sheet strength, emphasizing businesses with durable earnings and stronger financial positions that may hold up better during periods of market volatility.

Via The Motley Fool · March 10, 2026

The U.S. labor market sent a seismic shock through global financial markets on Tuesday, March 10, 2026, as the Bureau of Labor Statistics reported a staggering contraction in non-farm payrolls for February. While economists had braced for a modest gain of roughly 70,000 jobs, the actual figure plummeted

Via MarketMinute · March 10, 2026

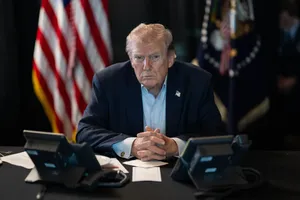

President Trump on Tuesday said that the investment from India’s Reliance Industries will help American Refining Group open its first oil refinery in the area in 50 years.

Via Stocktwits · March 10, 2026

In a post on Truth Social, the president said that while the U.S. does not have any reports of Iran placing such mines, they would have to be removed immediately.

Via Stocktwits · March 10, 2026

Mohamed El-Erian, Egyptian-American economist and Chief Economic Advisor at Allianz, said on Tuesday in a post on X that he expected the turbulence to persist.

Via Stocktwits · March 10, 2026

According to a report from The Wall Street Journal, Boeing said that it found scratched wiring in undelivered planes and traced the problem to a machining error.

Via Stocktwits · March 10, 2026

According to a report from CNBC, Amazon’s senior vice president of eCommerce Foundation, Dave Treadwell, plans to address recent outage issues at a retail technology meeting.

Via Stocktwits · March 10, 2026

In a dramatic display of market volatility, U.S. stock indices staged a massive intraday reversal on Tuesday, March 10, 2026, as investors pivoted from early-morning panic to afternoon optimism. After opening the session with steep losses of 1.5% across the board due to escalating fears of a prolonged

Via MarketMinute · March 10, 2026

According to an Axios report, this effort will see the companies tapping into underused electricity grid capacity, as part of a new coalition named Utilize.

Via Stocktwits · March 10, 2026

Hegseth did not rule out the possibility of U.S. boots on the ground in Iran, while acknowledging that there could be additional American casualties.

Via Stocktwits · March 10, 2026

Blue Owl Capital recently restricted investors from pulling money from one of its debt funds.

Via The Motley Fool · March 10, 2026

During an interview with CNBC, Iran’s Ministry of Foreign Affairs spokesperson Esmail Baghaei stated that the country was defending itself.

Via Stocktwits · March 10, 2026

Wired reported details of Nvidia’s forthcoming agentic AI platform, NemoClaw, which appears similar to the viral tool OpenClaw, ahead of the company’s annual developer conference in San Jose next week.

Via Stocktwits · March 10, 2026

Data from Stocktwits indicated that retail sentiment on SPY and QQQ was stabilizing.

Via Stocktwits · March 10, 2026