Newmont Mining (NEM)

116.21

-2.69 (-2.26%)

NYSE · Last Trade: Mar 11th, 9:24 PM EDT

Today's inflation report spooked gold investors. Newmont is cheap enough that they probably shouldn't worry.

Via The Motley Fool · March 11, 2026

In a move that has stunned global markets and signaled a paradigm shift in the perception of sovereign risk, gold prices have solidified their position above the $5,000 mark, trading at a historic $5,158 per ounce as of March 11, 2026. This monumental surge comes on the heels

Via MarketMinute · March 11, 2026

LONDON — In a move that has sent shockwaves through global financial centers, the price of gold surged to an unprecedented $5,171 per ounce today, March 11, 2026. The historic milestone represents a psychological and technical breakout that few analysts thought possible just two years ago. As the "Great Convergence"

Via MarketMinute · March 11, 2026

In the first quarter of 2026, the global financial landscape reached a psychological and structural tipping point as gold prices breached the historic $5,000 per ounce milestone. This surge, representing a doubling of value in less than two years, has fundamentally altered the role of the precious metal from

Via MarketMinute · March 11, 2026

As the global financial landscape shifts into a new era of commodity-driven dominance, Newmont Corp (NYSE: NEM) has officially ushered in what analysts are calling the "Golden Age" of profitability. Reporting its first-quarter results for 2026, the Denver-based mining giant stunned Wall Street with an earnings beat of 72 cents

Via MarketMinute · March 11, 2026

Spot gold prices held firm at $5,210 per ounce on Wednesday, March 11, 2026, as the international community braced for a wider conflict following a week of escalating hostilities between the United States and Iran. With the Pentagon reporting a series of "intense and sustained" precision strikes across Iranian

Via MarketMinute · March 11, 2026

As of March 10, 2026, the global financial landscape is undergoing a seismic shift as gold prices shatter historical records, firmly establishing what analysts are calling the "2026 Gold Supercycle." Spot gold has climbed to an unprecedented nearly $5,200 per ounce, driven by a potent cocktail of geopolitical escalation

Via MarketMinute · March 10, 2026

March 10, 2026 — In a historic day for global commodities, gold prices surged to an unprecedented $5,195.60 per ounce, marking a watershed moment in financial history. The precious metal, long considered the ultimate store of value, breached the $5,000 psychological barrier as a "perfect storm" of geopolitical

Via MarketMinute · March 10, 2026

The era of post-pandemic price volatility appears to be reaching a definitive conclusion. According to the World Bank’s latest 'Commodity Markets Outlook' report, global commodity prices are projected to plunge to a six-year low by the end of 2026. This downward trajectory is expected to be led by a

Via MarketMinute · March 10, 2026

As of March 10, 2026, the global financial order is undergoing a tectonic shift. Gold has solidified its position above the historic $5,000 per ounce milestone, fundamentally altering the calculus of sovereign wealth and institutional portfolios. For the first time in three decades, the "yellow metal" has overtaken U.

Via MarketMinute · March 10, 2026

The long-simmering tension between the world’s two largest gold producers has finally boiled over into a public legal confrontation. Newmont (NYSE: NEM) has formally issued a Notice of Default to Barrick Gold (NYSE: GOLD), alleging "operational decline" and systematic mismanagement at their Nevada Gold Mines (NGM) joint venture. The

Via MarketMinute · March 10, 2026

As of March 10, 2026, the global mining sector is witnessing a seismic shift in capital allocation and investor confidence, spearheaded by the staggering financial results of Barrick Gold (NYSE: GOLD). Following a year where gold prices shattered multiple ceilings to trade consistently above the $4,000 per ounce mark,

Via MarketMinute · March 10, 2026

In a trading session that will likely be remembered as a watershed moment for 2026 financial markets, precious metals surged to unprecedented heights on March 10 following unexpected diplomatic signals from the White House. Spot gold prices shattered previous resistance levels to hit $5,180 per ounce, while silver staged

Via MarketMinute · March 10, 2026

March 9, 2026 — The global financial landscape has been fundamentally reshaped in the opening months of 2026, as a historic surge in precious metals prices sends shockwaves through international markets. Driven by a catastrophic escalation of geopolitical conflict in the Middle East, gold and silver have transcended their traditional roles

Via MarketMinute · March 9, 2026

The opening quarter of 2026 has ushered in a dramatic transformation across the U.S. equity landscape, as the multi-year dominance of mega-cap technology gives way to a broad-based "Great Rotation." Investors are aggressively reallocating capital out of the high-flying artificial intelligence (AI) and software sectors, pivoting instead toward the

Via MarketMinute · March 9, 2026

Gold rose along with geopolitical tensions, and Newmont delivered an earnings beat.

Via The Motley Fool · March 9, 2026

Two macroeconomic factors are affecting Newmont stock today.

Via The Motley Fool · March 9, 2026

By: MarketMinute

In a startling divergence from historical market behavior, precious metals saw a significant sell-off on March 9, 2026, even as energy markets braced for an inflationary shock. Gold futures fell 1.24% to settle at $5,107 per ounce, while silver dropped 1.32% to $83.33 per

Via MarketMinute · March 9, 2026

As of March 9, 2026, the global gold market is witnessing an unprecedented regional decoupling that has left analysts and bullion traders stunned. While the yellow metal has surged to historic highs—trading in a volatile range between $5,100 and $5,400 per ounce—the two largest physical consumers,

Via MarketMinute · March 9, 2026

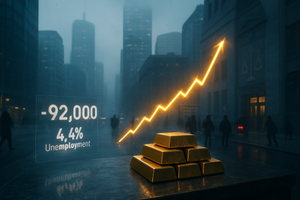

The United States economy was sent into a tailspin this past week following the release of a devastating February jobs report that has shattered the prevailing "soft landing" narrative. On March 6, 2026, the Bureau of Labor Statistics revealed an unexpected contraction of 92,000 jobs, a stark reversal from

Via MarketMinute · March 9, 2026

The traditional status of gold as a "safe haven" faced its most severe test in a decade last week as institutional investors executed a historic retreat from precious metals. On March 4, 2026, the SPDR Gold Trust (NYSE Arca: GLD) recorded a staggering net cash outflow of $2.91 billion

Via MarketMinute · March 9, 2026

The global financial landscape has been thrust into a state of high-intensity volatility as of March 9, 2026. Following a series of precision strikes by U.S. and Israeli forces on critical Iranian oil facilities—part of the escalating "Operation Epic Fury"—Brent crude oil prices have skyrocketed past the

Via MarketMinute · March 9, 2026

Precious metals experienced a sharp correction on Monday, March 9, 2026, as a resurgent U.S. dollar and climbing Treasury yields forced investors to lock in profits following a historic multi-month rally. Spot gold fell 2.5% to settle at $5,041.89 per ounce, while silver took a more

Via MarketMinute · March 9, 2026

Which S&P500 stocks are moving before the opening bell on Monday?chartmill.com

Via Chartmill · March 9, 2026

Investors in the gold stock have more than doubled their money in one year. What's next?

Via The Motley Fool · March 9, 2026