General Motors (GM)

74.61

-0.32 (-0.43%)

NYSE · Last Trade: Mar 11th, 2:23 PM EDT

Detailed Quote

| Previous Close | 74.93 |

|---|---|

| Open | 75.46 |

| Bid | 74.59 |

| Ask | 74.63 |

| Day's Range | 74.45 - 76.58 |

| 52 Week Range | 41.60 - 87.62 |

| Volume | 2,762,454 |

| Market Cap | 67.45B |

| PE Ratio (TTM) | 23.03 |

| EPS (TTM) | 3.2 |

| Dividend & Yield | 0.6000 (0.80%) |

| 1 Month Average Volume | 8,322,000 |

Chart

About General Motors (GM)

General Motors is a leading global automotive company that designs, manufactures, and sells a diverse range of vehicles, including cars, trucks, and SUVs under various brand names. The company is committed to innovation in transportation, focusing on the development of electric and autonomous vehicles to meet the evolving needs of consumers and address environmental challenges. With a rich history in the automotive industry, General Motors also emphasizes safety, performance, and technology integration in its products while working toward sustainability initiatives and expanding its presence in the global market. Read More

News & Press Releases

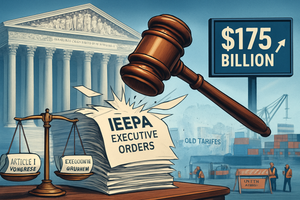

In a seismic shift for international trade and constitutional law, the Supreme Court of the United States ruled on February 20, 2026, that the Executive Branch lacks the inherent authority to impose peacetime tariffs under the International Emergency Economic Powers Act (IEEPA). The 6–3 decision in Learning Resources, Inc.

Via MarketMinute · March 11, 2026

Via FinancialNewsMedia · March 11, 2026

The February 2026 ADP National Employment Report has sent a clear signal of stability to Wall Street, revealing that private sector employers added 63,000 jobs during the month. This figure comfortably surpassed the consensus analyst estimate of 50,000, suggesting that despite persistent high interest rates and global economic

Via MarketMinute · March 10, 2026

In a seismic shift for global trade policy, the U.S. Supreme Court issued a landmark 6-3 ruling on February 20, 2026, in the case of Learning Resources, Inc. v. Trump, effectively invalidating the administration's broad use of emergency powers to levy tariffs. The Court determined that the International Emergency

Via MarketMinute · March 10, 2026

A company that generates cash isn’t automatically a winner. Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand. Luc...

Via StockStory · March 10, 2026

Goldman Sachs (NYSE: GS) delivered a resounding message to the financial world this morning, reporting a massive fourth-quarter earnings beat that has analysts recalibrating their outlooks for the entire investment banking sector. As analyzed on March 9, 2026, the firm reported earnings per share (EPS) of $14.01, obliterating the

Via MarketMinute · March 9, 2026

As the financial world pivots toward the end of the first quarter of 2026, all eyes are fixed on the upcoming Personal Consumption Expenditures (PCE) price index report. Market participants and economists have coalesced around an expected 2.2% year-over-year (YoY) figure, a metric that has become the definitive yardstick

Via MarketMinute · March 9, 2026

As of March 9, 2026, the global technology landscape is undergoing its most profound transformation since the dawn of the internet, fueled by the maturation of generative artificial intelligence (AI) and the rise of the autonomous edge. At the epicenter of this shift is Hewlett Packard Enterprise (NYSE: HPE), a company that has successfully shed [...]

Via Finterra · March 9, 2026

These three stocks have serious potential over the next decade, even if the media doesn't pay too much attention to their success.

Via The Motley Fool · March 7, 2026

This marks the 17th consecutive year that this automaker engendered the highest loyalty among car buyers.

Via The Motley Fool · March 7, 2026

Rivian has plans to sell 20,000 to 25,000 R2 vehicles in 2026, a goal that could put the vehicle in record company.

Via Benzinga · March 6, 2026

As of March 6, 2026, Tesla Inc. (NASDAQ: TSLA) finds itself at a historical crossroads. Once the undisputed vanguard of the global electric vehicle (EV) revolution, the Austin-headquartered titan is currently navigating a complex "identity transition." The company is shifting its strategic weight from a pure-play automotive manufacturer toward a multifaceted powerhouse of "Physical AI" [...]

Via Finterra · March 6, 2026

Being early to the EV market may have cost these automakers billions, but history says the alternative could have been worse.

Via The Motley Fool · March 5, 2026

WASHINGTON, D.C. — In a landmark decision that has sent shockwaves through global supply chains and the halls of K Street, the U.S. Supreme Court has dealt a significant blow to executive trade authority. As of today, March 5, 2026, the financial markets are reacting to a dual-pronged development:

Via MarketMinute · March 5, 2026

While Ford Motor has outperformed relative to the consumer cyclical sector over the past year, Wall Street analysts maintain a cautious outlook on the stock’s prospects.

Via Barchart.com · March 5, 2026

As of March 5, 2026, Tesla, Inc. (NASDAQ: TSLA) finds itself at a historic inflection point. Long celebrated as the undisputed leader of the electric vehicle (EV) revolution, the company has spent the last 24 months navigating a "identity transition" that has polarized Wall Street. While the automotive industry globally is grappling with a cooling [...]

Via Finterra · March 5, 2026

General Motors stock has outpaced the Nasdaq over the past year, while analysts remain moderately bullish about its prospects.

Via Barchart.com · March 5, 2026

The global commodities market faced a "Bloody Tuesday" and a tumultuous Wednesday as platinum prices plummeted 9.5%, falling to $2,088 per ounce on March 3-4, 2026. This sharp decline was part of a broader liquidation event triggered by a dramatic escalation in the Middle East conflict, specifically the

Via MarketMinute · March 4, 2026

General Motors’s 32.8% return over the past six months has outpaced the S&P 500 by 27.1%, and its stock price has climbed to $77.22 per share. This was partl...

Via StockStory · March 3, 2026

Berkshire Hathaway's GM investment made the conglomerate some money, but it could have been a lot more profitable.

Via The Motley Fool · March 3, 2026

As the Federal Reserve prepares for its crucial March 17–18, 2026, policy meeting, Chair Jerome Powell and the Board of Governors find themselves at a historic crossroads. The U.S. economy has entered a paradoxical phase where inflationary pressures from a new, aggressive trade regime are colliding with a

Via MarketMinute · March 3, 2026

The global financial markets have entered a period of profound "legalized volatility" following the White House’s emergency invocation of Section 122 of the Trade Act of 1974. This move, triggered by a landmark Supreme Court ruling on February 20, 2026, has replaced previous executive-led trade actions with a 10%

Via MarketMinute · March 3, 2026

NEW YORK — In a dramatic shift for global markets, the yield on the benchmark 10-year U.S. Treasury note fell below the psychologically significant 4% mark on Tuesday, reaching its lowest level since late 2025. This sudden "flight to quality" comes as investors grapple with a volatile cocktail of deteriorating

Via MarketMinute · March 3, 2026

In a landmark moment for the electric vehicle (EV) charging industry, EVgo Inc. (NASDAQ: EVGO) has reported its first-ever quarter of positive adjusted EBITDA, marking a significant shift from a period of heavy capital expenditure to one of operational sustainability. For the fourth quarter ending December 31, 2025, the company

Via MarketMinute · March 3, 2026

In a landmark decision that has sent shockwaves through global markets, the U.S. Supreme Court on February 20, 2026, fundamentally stripped the executive branch of its most potent trade weapon. The 6-3 ruling in Learning Resources Inc. v. Trump declared that the International Emergency Economic Powers Act (IEEPA)—the

Via MarketMinute · March 3, 2026