AngloGold Ashanti PLC Ordinary Shares (AU)

106.84

+7.81 (7.89%)

NYSE · Last Trade: Jan 20th, 5:47 PM EST

As the price of gold shatters historical records, reaching a staggering $4,600 per ounce, the world’s two largest gold producers are locked in a high-stakes corporate standoff that could redefine the global mining landscape. Rumors are swirling across Wall Street and Bay Street that Newmont Corporation (NYSE: NEM)

Via MarketMinute · January 20, 2026

The global financial landscape reached a fever pitch this Monday, January 19, 2026, as precious metals shattered all previous records. Gold surged to a staggering $4,700 per ounce, while Silver broke past the $93 mark, fueled by a perfect storm of aggressive U.S. foreign policy and a weakening

Via MarketMinute · January 19, 2026

Via MarketBeat · January 19, 2026

AngloGold Ashanti PLC (NYSE:AU) Fits the 'Affordable Growth' Investment Profilechartmill.com

Via Chartmill · January 19, 2026

AngloGold Ashanti (NYSE:AU) Shows Perfect Technical Rating and High-Quality Breakout Setupchartmill.com

Via Chartmill · January 12, 2026

AngloGold Ashanti (NYSE:AU) Combines High-Growth Momentum with Bullish Technical Setupchartmill.com

Via Chartmill · January 9, 2026

As of January 13, 2026, the global financial landscape is witnessing a historic structural repricing of precious metals. Gold has shattered expectations, surging past the $4,600 per ounce mark, while silver has accelerated into "price discovery" territory, trading north of $85 per ounce. This vertical ascent has finally ignited

Via MarketMinute · January 13, 2026

ANGLOGOLD ASHANTI PLC (NYSE:AU) Shows Strong Fundamentals and Technical Setup for Growthchartmill.com

Via Chartmill · January 6, 2026

ACCRA, Ghana — In a stunning reversal of a decades-long trend of devaluation, the Ghanaian Cedi has closed 2025 as one of the world’s strongest-performing currencies, marking its first annual appreciation against the U.S. Dollar in 32 years. This historic rally, fueled by a relentless surge in global gold

Via MarketMinute · December 31, 2025

The final trading week of 2025 has been marked by a dramatic "flash crash" in the precious metals sector, as a series of aggressive margin requirement hikes by major exchanges brought a parabolic rally to a screeching halt. On December 29, 2025, gold and silver prices plummeted from historic highs,

Via MarketMinute · December 29, 2025

Everyone's selling silver and gold today, but with Anglogold profits poised to surge 73%, selling today is probably a mistake.

Via The Motley Fool · December 29, 2025

These three stocks delivered high yields and high performance this year.

Via The Motley Fool · December 28, 2025

As the calendar turns toward the end of 2025, the financial world is witnessing a historic surge in the precious metals sector, with gold prices shattering previous records to trade consistently above the $4,500 per ounce mark. At the center of this "Golden Renaissance" is Franco-Nevada Corporation (NYSE: FNV)

Via MarketMinute · December 24, 2025

Anglogold Ashanti (AU) exemplifies GARP investing with strong earnings growth, a reasonable valuation, and solid financial health.

Via Chartmill · December 23, 2025

As the sun sets on 2025, the bustling markets of Accra are breathing a sigh of relief that seemed impossible just twelve months ago. On December 22, 2025, Ghana’s economic narrative has shifted from a cautionary tale of debt distress to a remarkable, if fragile, recovery. The Ghanaian Cedi,

Via MarketMinute · December 22, 2025

In a historic session for the precious metals market, AngloGold Ashanti (NYSE: AU) soared to an all-time high of $89.37 on December 22, 2025. This milestone marks a staggering 292% year-to-date gain for the mining giant, a performance that has not only redefined the company’s valuation but has

Via MarketMinute · December 22, 2025

AngloGold Ashanti rode the gold price acceleration wave to a 245% return this year.

Via The Motley Fool · December 21, 2025

Anglogold Ashanti (AU) presents a value investing opportunity, combining strong fundamentals, profitability, and growth potential with a currently undervalued stock price.

Via Chartmill · December 19, 2025

As 2025 draws to a close, Franco-Nevada Corporation (TSX:FNV) (NYSE:FNV) has solidified its position as the premier vehicle for precious metals exposure, orchestrating a remarkable financial turnaround that has captivated Wall Street and Bay Street alike. Following a tumultuous 2024 defined by geopolitical friction and the shuttering of

Via MarketMinute · December 18, 2025

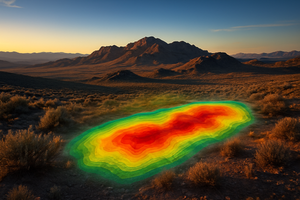

RENO, NV — In a move that underscores the intensifying gold rush within the Walker Lane trend, Black Mammoth Metals Corp. (TSXV: BMM) (OTC: LQRCF) announced today, December 18, 2025, the strategic acquisition of the Mustang Gold and Silver Property in Nye County, Nevada. The acquisition, executed through the staking of

Via MarketMinute · December 18, 2025

AngloGold Ashanti (AU) stock shows strong technical momentum and a high-quality setup, signaling a potential breakout entry for trend-following investors.

Via Chartmill · December 16, 2025

AngloGold Ashanti (AU) combines explosive earnings growth with strong technical trends, presenting a high-momentum breakout setup for investors.

Via Chartmill · December 12, 2025

AngloGold Ashanti (AU) presents a strong GARP investment case, combining high growth, solid profitability, and a reasonable valuation based on forward earnings.

Via Chartmill · December 2, 2025

Global markets are currently grappling with a complex and often contradictory landscape in commodity prices, driven by a confluence of geopolitical tensions, persistent supply chain disruptions, and evolving economic policies. As of December 2025, a "great divergence" has become the defining characteristic of the commodity sector. While some commodities, particularly

Via MarketMinute · December 17, 2025

The global financial landscape is currently experiencing a profound transformation, with gold and silver prices soaring to unprecedented heights. As of December 9, 2025, a potent cocktail of geopolitical tensions, hawkish trade policies, and an insatiable industrial appetite from the burgeoning data center and electric vehicle (EV) sectors is fueling

Via MarketMinute · December 9, 2025