United Airlines Holdings, Inc. - Common Stock (UAL)

90.38

-0.72 (-0.79%)

NASDAQ · Last Trade: Mar 11th, 3:44 PM EDT

This little eVTOL maker could have a bright future.

Via The Motley Fool · March 11, 2026

In a resounding signal of economic resilience, the Institute for Supply Management (ISM) reported on March 3, 2026, that the Services PMI surged to 56.1 in February, marking its highest reading since July 2022. This unexpected acceleration defies long-standing recessionary fears and underscores a "No Landing" scenario for the

Via MarketMinute · March 11, 2026

The global financial landscape underwent a seismic shift over the last 48 hours as President Donald Trump delivered a series of contradictory statements regarding the eleven-day-old conflict with Iran. After the initial shock of "Operation Epic Fury"—the U.S.-led air campaign that began on February 28, 2026—sent

Via MarketMinute · March 11, 2026

In a move described by market analysts as the "ultimate energy bazooka," the International Energy Agency (IEA) has officially authorized the release of 400 million barrels of crude oil from emergency reserves. Announced today, March 11, 2026, this intervention marks the largest collective action in the agency’s 50-year history,

Via MarketMinute · March 11, 2026

NEW YORK — Global energy markets are in a state of high alert as West Texas Intermediate (WTI) crude oil surged 4.48% to $87.19 per barrel, while the international benchmark, Brent crude, climbed to $91.58. The sharp spike follows alarming reports that Iran has begun disrupting or effectively

Via MarketMinute · March 11, 2026

As of March 11, 2026, the global energy market is locked in a state of high-intensity volatility, with Brent Crude prices hovering precariously around the $90 per barrel mark. This pricing level represents an uneasy equilibrium following a chaotic fortnight of military escalations in the Middle East that have effectively

Via MarketMinute · March 11, 2026

The "fear gauge" of Wall Street has officially sounded the alarm. On March 11, 2026, the CBOE Volatility Index (VIX) surged to 25.07, marking a dramatic departure from the relative calm of early winter and signaling a high-stress regime for global equity markets. This spike, representing a 57% increase

Via MarketMinute · March 11, 2026

As the sun rises over Wall Street on Wednesday, March 11, 2026, the global financial landscape is characterized by a tense equilibrium. The 10-year Treasury yield has found a precarious footing at 4.15%, serving as a valuation anchor for a market caught between the immediate safe-haven demands of a

Via MarketMinute · March 11, 2026

Boeing (NYSE: BA) faced a sharp sell-off on Tuesday after the aerospace giant confirmed a new production quality issue involving the electrical wiring of its 737 MAX aircraft. The discovery of "small scratches" on wiring bundles in newly constructed, undelivered jets has forced an immediate pause in deliveries, marking a

Via MarketMinute · March 11, 2026

In a Tuesday that will be etched into the memory of commodities traders for years, a single social media post from US Energy Secretary Chris Wright sent global energy markets into a tailspin. On March 10, 2026, a post appeared on Wright’s official X account claiming that the US

Via MarketMinute · March 11, 2026

In a decisive move to prevent a global economic meltdown, the International Energy Agency (IEA) has proposed the largest coordinated release of strategic petroleum reserves in its 52-year history. The proposal, announced early this morning on March 11, 2026, involves the emergency deployment of over 182 million barrels of crude

Via MarketMinute · March 11, 2026

Analyst cuts, surging options activity, and Middle East tensions put this airline’s outlook under scrutiny today, March 10, 2026.

Via The Motley Fool · March 10, 2026

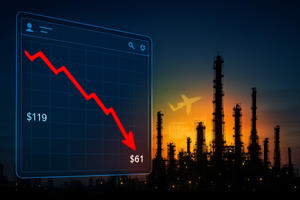

NEW YORK — In a dramatic reversal that has caught energy traders off guard, West Texas Intermediate (WTI) crude oil prices plummeted on Tuesday, March 10, 2026, falling into the $81 to $90 range after hitting a terrifying weekend high of nearly $119 per barrel. This sharp 25% retreat from the

Via MarketMinute · March 10, 2026

Via MarketBeat · March 10, 2026

In a dramatic Tuesday trading session on March 10, 2026, Kohl’s Corp (NYSE: KSS) emerged as a standout performer in the S&P 500, with shares jumping more than 7.3% to lead the index’s gains. The surge was fueled by a potent combination of a significant fourth-quarter

Via MarketMinute · March 10, 2026

NEW YORK — U.S. equity markets witnessed a stunning reversal on Tuesday, March 10, 2026, as investors pivoted from geopolitical panic to a full-throttle "relief rally." The catalyst for the turnaround was a series of afternoon comments from President Donald Trump, who suggested that the intensifying conflict with Iran could

Via MarketMinute · March 10, 2026

Global energy markets experienced a historic "whiplash" on March 10, 2026, as Brent crude futures underwent a violent $30 price swing in less than 48 hours. After surging toward a multi-year peak of nearly $120 a barrel on fears of a total blockade in the Strait of Hormuz, prices collapsed

Via MarketMinute · March 10, 2026

In a trading session defined by breathtaking whiplash, U.S. equity markets staged one of the most significant intraday reversals in financial history on Monday, March 9, 2026. After an opening bell triggered a wave of selling that saw the Dow Jones Industrial Average plummet nearly 900 points, investors executed

Via MarketMinute · March 10, 2026

LONDON / WASHINGTON — In an emergency effort to prevent a global inflationary spiral, G7 finance ministers and central bank governors held a high-stakes video conference on March 9, 2026, to finalize a framework for a massive, coordinated release of Strategic Petroleum Reserves (SPR). The move comes as the "fear premium" in

Via MarketMinute · March 10, 2026

March 10, 2026 — In a historic day for global commodities, gold prices surged to an unprecedented $5,195.60 per ounce, marking a watershed moment in financial history. The precious metal, long considered the ultimate store of value, breached the $5,000 psychological barrier as a "perfect storm" of geopolitical

Via MarketMinute · March 10, 2026

Global energy markets experienced a historic correction on March 10, 2026, as crude oil prices plummeted from recent multi-year highs. Benchmark West Texas Intermediate (WTI) fell sharply to settle between $88 and $89 per barrel, while Brent crude, the international standard, dropped to $92. The sudden retreat marks a significant

Via MarketMinute · March 10, 2026

LONDON — In a high-stakes effort to prevent a global economic "stagflation" trap, finance ministers from the Group of Seven (G7) nations issued a definitive joint statement on March 10, 2026, declaring their collective readiness to authorize a massive, coordinated release of strategic oil reserves. The move comes as the "Iran

Via MarketMinute · March 10, 2026

In a day defined by historic whiplash, the global energy markets witnessed a dramatic cooling on March 10, 2026. Crude oil prices, which had flirted with $120 per barrel just hours earlier amidst fears of a prolonged Middle Eastern conflagration, plummeted 6.25% to settle at $88.85 USD/Bbl.

Via MarketMinute · March 10, 2026

Check out the companies making headlines yesterday: United Airlines (NASDAQ:UAL): Airline company United Airlines Holdings (NASDAQ:UAL) fell by 5.9% on Monda...

Via StockStory · March 10, 2026

On March 9, 2026, the airline erased some of its losses on reports that Iran conflict may soon end.

Via The Motley Fool · March 9, 2026