Honeywell International (HON)

219.39

+0.00 (0.00%)

NASDAQ · Last Trade: Jan 20th, 8:16 AM EST

Detailed Quote

| Previous Close | 219.39 |

|---|---|

| Open | - |

| Bid | 217.91 |

| Ask | 219.85 |

| Day's Range | N/A - N/A |

| 52 Week Range | 169.05 - 227.82 |

| Volume | 13,176 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 4.760 (2.17%) |

| 1 Month Average Volume | 3,942,766 |

Chart

About Honeywell International (HON)

Honeywell International is a diversified technology and manufacturing company that operates in various sectors, including aerospace, building technologies, performance materials and technologies, and safety and productivity solutions. The company develops and provides innovative products, services, and solutions designed to enhance efficiency, safety, and sustainability in various industries. Honeywell focuses on leveraging advanced software and automation to improve performance and operational capabilities for its customers, while also emphasizing environmentally responsible practices and the development of cutting-edge technologies. Read More

News & Press Releases

In alignment with the United Nations 2030 Agenda for Sustainable Development, the Regional Comprehensive Economic Partnership (RCEP), and the high-quality development of the Belt and Road Initiative, the World Federation of Free Trade Zones (WFFTZ) — a leading international organization dedicated to advancing global free trade — is pleased to announce the launch of the WFFTZ Global Awards.

Via Get News · January 19, 2026

Movers and shakers in today's after-hours session for S&P500 stocks?chartmill.com

Via Chartmill · January 19, 2026

As of mid-January 2026, a seismic shift is occurring in the hallowed halls of Wall Street and the research labs of Silicon Valley. After three years of an unprecedented artificial intelligence bull market that reshaped the global economy, institutional capital is beginning to rotate. The new destination is not just

Via MarketMinute · January 19, 2026

What’s Driving Honeywell Shares Up Today?stocktwits.com

Via Stocktwits · January 14, 2026

Date: January 19, 2026 Author: Finterra Research Team Introduction As the opening bell prepares to ring on a new week, all eyes in the industrial sector are fixed on St. Paul. 3M Company (NYSE: MMM), once the poster child for "litigation-induced value traps," has undergone a metamorphosis over the last 24 months. Today, on the [...]

Via Finterra · January 19, 2026

A company that generates cash isn’t automatically a winner.

Some businesses stockpile cash but fail to reinvest wisely, limiting their ability to expand.

Via StockStory · January 18, 2026

As of mid-January 2026, the global financial markets are witnessing a profound structural rotation. For three years, Artificial Intelligence (AI) has been the undisputed engine of market growth, propelling indices to record highs. However, with "AI fatigue" setting in and the physical limits of silicon-based hardware becoming an inescapable bottleneck

Via MarketMinute · January 16, 2026

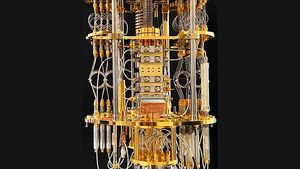

Honeywell is considering a debut for its quantum computing division, Quantinuum.

Via Barchart.com · January 16, 2026

Via Benzinga · January 16, 2026

As the global demand for artificial intelligence reaches an atmospheric peak, a revolutionary computing architecture known as Computational RAM (CRAM) is poised to solve the industry’s most persistent bottleneck. By performing calculations directly within the memory cells themselves, CRAM effectively eliminates the "memory wall"—the energy-intensive data transfer between storage and processing—promising an unprecedented 2,500-fold increase [...]

Via TokenRing AI · January 16, 2026

As the global economy shakes off the final remnants of the high-interest-rate era, a massive wave of consolidation is sweeping through corporate boardrooms. Analysts have officially adjusted their forecasts for 2026, projecting a staggering $5.1 trillion in total deal volume—a figure that would eclipse the previous records of

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

As the opening bells of 2026 fade into a bustling January, the financial world is grappling with one of the most aggressive forecasts in modern market history. Following a robust 18% total return in 2025 that saw the S&P 500 close the year at 6,845.50, a defiant

Via MarketMinute · January 15, 2026

As 2026 begins, the global mergers and acquisitions (M&A) market is witnessing a profound "renaissance," driven by a confluence of stabilizing interest rates, record levels of corporate cash, and a strategic pivot toward high-growth technology. Morgan Stanley (NYSE: MS) recently released a bullish outlook for the year, projecting a

Via MarketMinute · January 15, 2026

As we enter the first weeks of 2026, the narrative of a stock market dominated by a handful of tech giants has finally given way to a more balanced and resilient economic landscape. For the first time since the post-pandemic recovery, the S&P 500 index is no longer relying

Via MarketMinute · January 15, 2026

Is the Nvidia partner and data center infrastructure company's stock a buy now?

Via The Motley Fool · January 15, 2026

The S&P 500 has kicked off 2026 with a powerful display of momentum, climbing 1.9% in the first two weeks of the year to reach historic levels. Following a robust 16.4% gain in 2025, the index hit a record closing high of 6,977.32 on January

Via MarketMinute · January 14, 2026

Via Benzinga · January 14, 2026

Quantinuum files for IPO! Honeywell (HON) stock climbs as its majority-owned quantum leader prepares to go public.

Via Benzinga · January 14, 2026

Honeywell said its majority-owned quantum computing unit Quantinuum will filing for an IPO, adding to the growing number of quantum computing stocks.

Via Investor's Business Daily · January 14, 2026

Brett Young is hitting the road in 2026 with his highly anticipated 2.0 Tour, celebrating his latest album 2.0 and bringing fans an intimate night of heartfelt storytelling, chart-topping hits like "In Case You Didn't Know," "Mercy," and new tracks such as "Drink With You." With singer-songwriter Jenna Davis opening the shows, this 18-date U.S. run promises unforgettable performances in stunning venues from the iconic Ryman Auditorium to theaters across the Midwest and Northeast.

Via AB Newswire · January 14, 2026

As the opening bell rang on January 13, 2026, the financial landscape appeared markedly different from the tech-dominated frenzy of the previous three years. Market analysts and institutional investors are increasingly aligning on a singular, provocative forecast: the Dow Jones Industrial Average is set to significantly outperform both the S&

Via MarketMinute · January 13, 2026

As of mid-January 2026, the United States economy finds itself at a pivotal crossroads, characterized by a transition from defensive posturing to a growth-oriented "Blue-Chip Renaissance." After a series of calculated interest rate cuts in the final months of 2025, the Federal Reserve has successfully steered the economy toward a

Via MarketMinute · January 13, 2026

As the trading floor lights flickered to life in early 2026, a new psychological benchmark took hold of the financial world: 8,000. Just two years after the S&P 500 first crossed the 5,000 threshold, a growing chorus of Wall Street’s most influential strategists is projecting that

Via MarketMinute · January 13, 2026

As of January 2, 2026, the global technology landscape is no longer defined merely by the chips that power artificial intelligence, but by the physical infrastructure that prevents them from melting. At the epicenter of this industrial renaissance is Vertiv Holdings Co. (NYSE: VRT). Once a steady but overlooked industrial division, Vertiv has transformed into [...]

Via PredictStreet · January 2, 2026