Cybersecurity platform provider CrowdStrike (NASDAQ:CRWD) announced better-than-expected revenue in Q2 CY2025, with sales up 21.3% year on year to $1.17 billion. On the other hand, next quarter’s revenue guidance of $1.21 billion was less impressive, coming in 1.3% below analysts’ estimates. Its non-GAAP profit of $0.93 per share was 12.1% above analysts’ consensus estimates.

Is now the time to buy CrowdStrike? Find out by accessing our full research report, it’s free.

CrowdStrike (CRWD) Q2 CY2025 Highlights:

- Revenue: $1.17 billion vs analyst estimates of $1.15 billion (21.3% year-on-year growth, 1.7% beat)

- Subscription Revenue: $1.10 billion vs analyst estimates of $1.10 billion (20% year-on-year growth, in line)

- Adjusted EPS: $0.93 vs analyst estimates of $0.83 (12.1% beat)

- Adjusted Operating Income: $255 million vs analyst estimates of $230.8 million (21.8% margin, 10.5% beat)

- The company slightly lifted its revenue guidance for the full year to $4.78 billion at the midpoint from $4.77 billion

- Management raised its full-year Adjusted EPS guidance to $3.66 at the midpoint, a 4.6% increase

- Operating Margin: -9.7%, down from 1.4% in the same quarter last year

- Free Cash Flow Margin: 24.3%, down from 25.3% in the previous quarter

- Annual Recurring Revenue: $4.66 billion vs analyst estimates of $4.64 billion (20.6% year-on-year growth, in line)

- Market Capitalization: $104.1 billion

“With reacceleration a quarter ahead of our expectations, CrowdStrike delivered an exceptional Q2. Record Q2 net new ARR of $221 million, over 1,000 Flex customers, and more than 100 re-flexes highlight CrowdStrike as the leader in cybersecurity consolidation,” said George Kurtz, Founder and CEO.

Company Overview

Known for detecting the massive SolarWinds hack in 2020 that compromised numerous government agencies, CrowdStrike (NASDAQ:CRWD) provides cloud-based cybersecurity solutions that protect endpoints, cloud workloads, identity, and data through its Falcon platform.

Revenue Growth

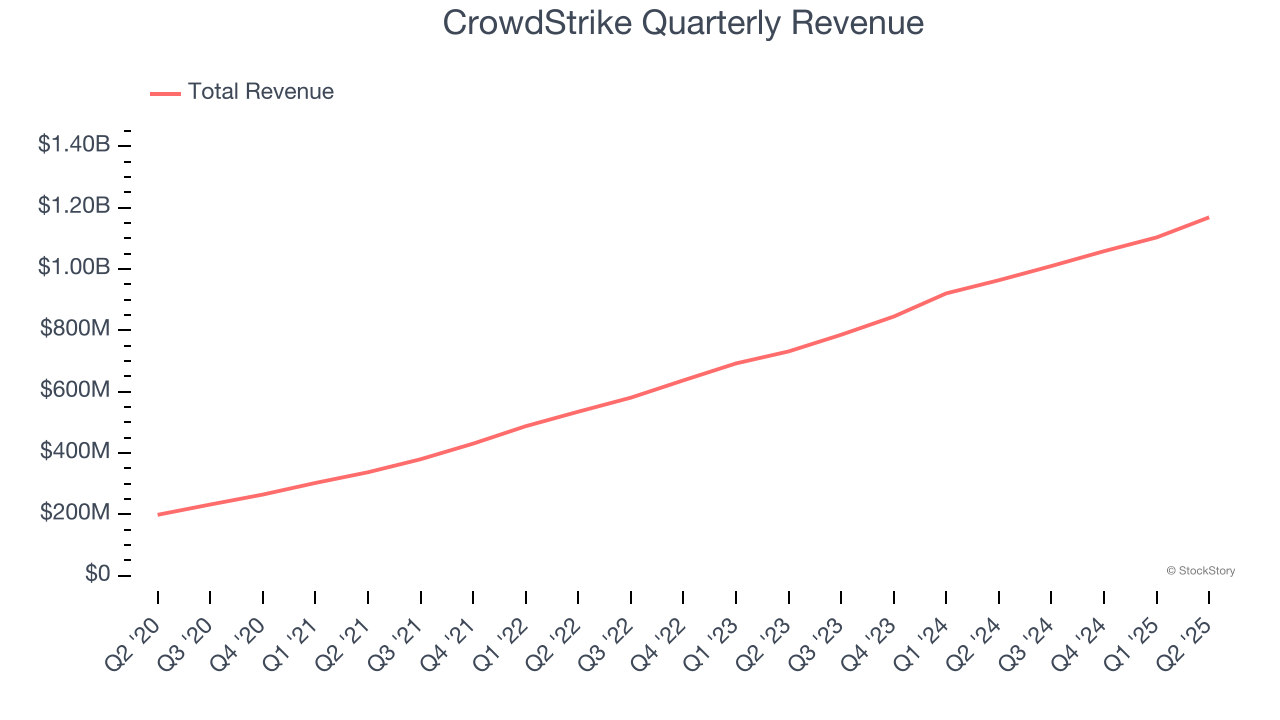

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, CrowdStrike’s 33.3% annualized revenue growth over the last three years was excellent. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, CrowdStrike reported robust year-on-year revenue growth of 21.3%, and its $1.17 billion of revenue topped Wall Street estimates by 1.7%. Company management is currently guiding for a 20.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.8% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is noteworthy and suggests the market is baking in success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Annual Recurring Revenue

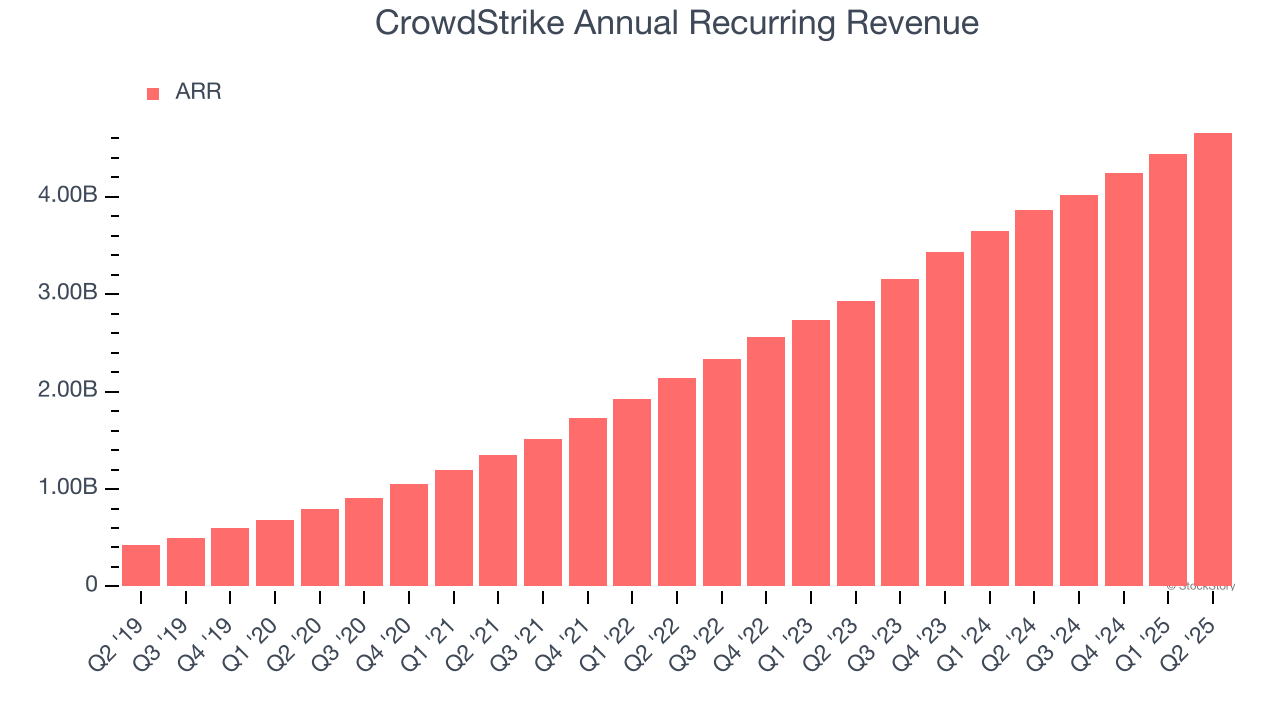

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

CrowdStrike’s ARR punched in at $4.66 billion in Q2, and over the last four quarters, its growth was impressive as it averaged 23.3% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes CrowdStrike a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

Customer Acquisition Efficiency

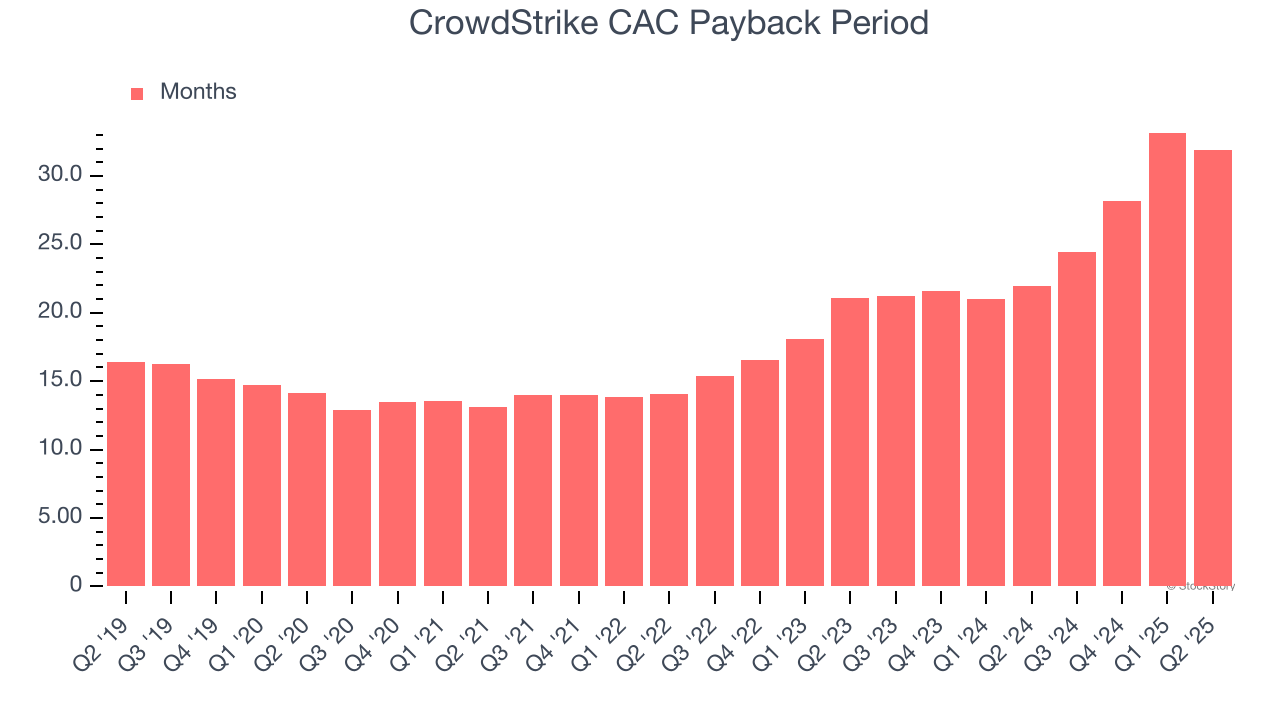

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

CrowdStrike is quite efficient at acquiring new customers, and its CAC payback period checked in at 31.9 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from CrowdStrike’s Q2 Results

Revenue beat slightly, but the all-important subscription revenue line was just in line with expectations. And while we were impressed by CrowdStrike’s EPS guidance for next quarter and the full year (both of which exceeded analysts’ expectations), revenue guidance for next quarter slightly missed. Overall, this print was fine, but investors were likely hoping for more from this premium-valuation software company. Shares traded down 6% to $397.23 immediately after reporting.

Big picture, is CrowdStrike a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.