The past six months have been a windfall for Primoris’s shareholders. The company’s stock price has jumped 59.9%, hitting $113.50 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is PRIM a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does PRIM Stock Spark Debate?

Listed on the NASDAQ in 2008, Primoris (NYSE:PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Two Things to Like:

1. Surging Backlog Locks In Future Sales

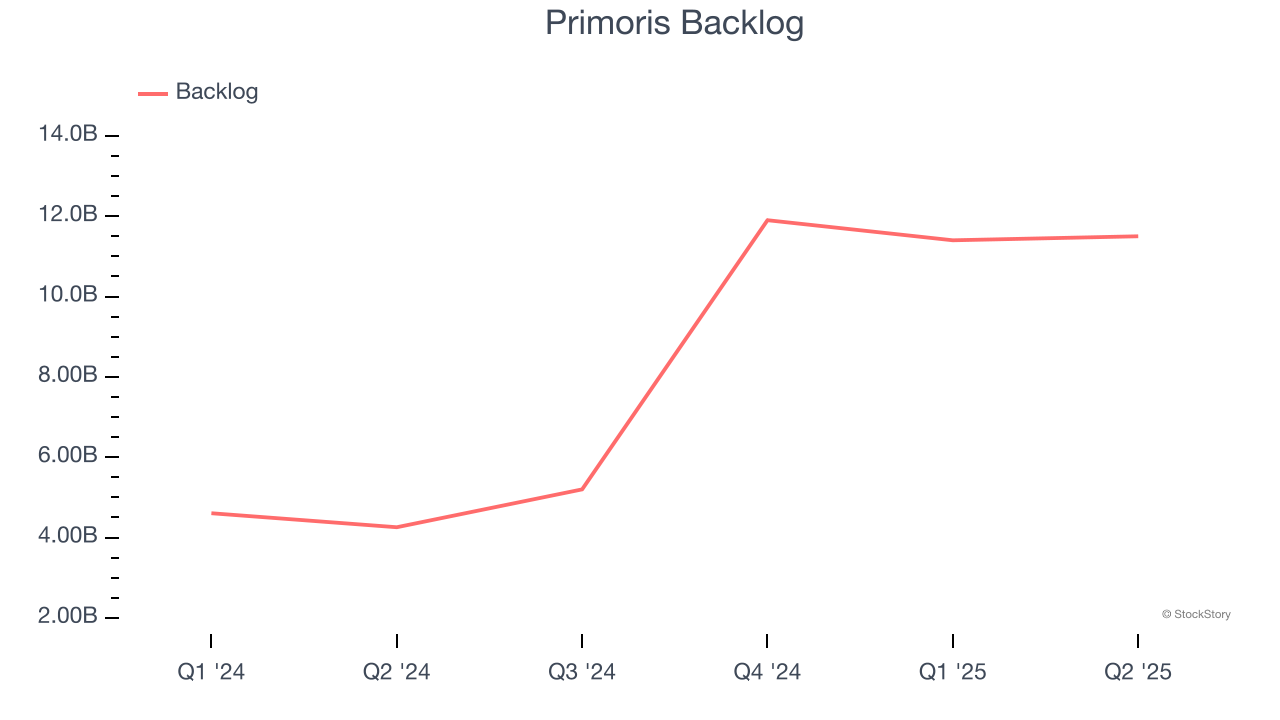

We can better understand Construction and Maintenance Services companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Primoris’s future revenue streams.

Primoris’s backlog punched in at $11.5 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 159%. This performance was fantastic and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to Primoris for the long term, enhancing the business’s predictability.

2. Outstanding Long-Term EPS Growth

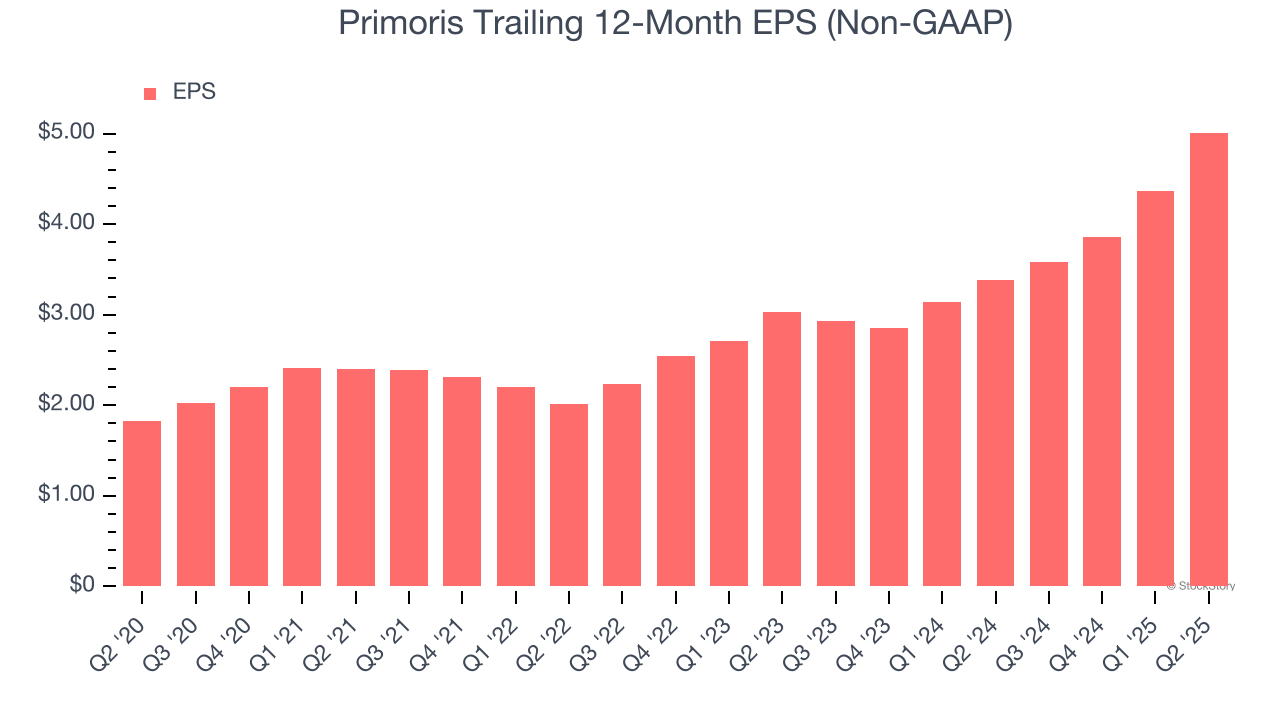

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Primoris’s EPS grew at an astounding 22.3% compounded annual growth rate over the last five years, higher than its 15.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Low Gross Margin Reveals Weak Structural Profitability

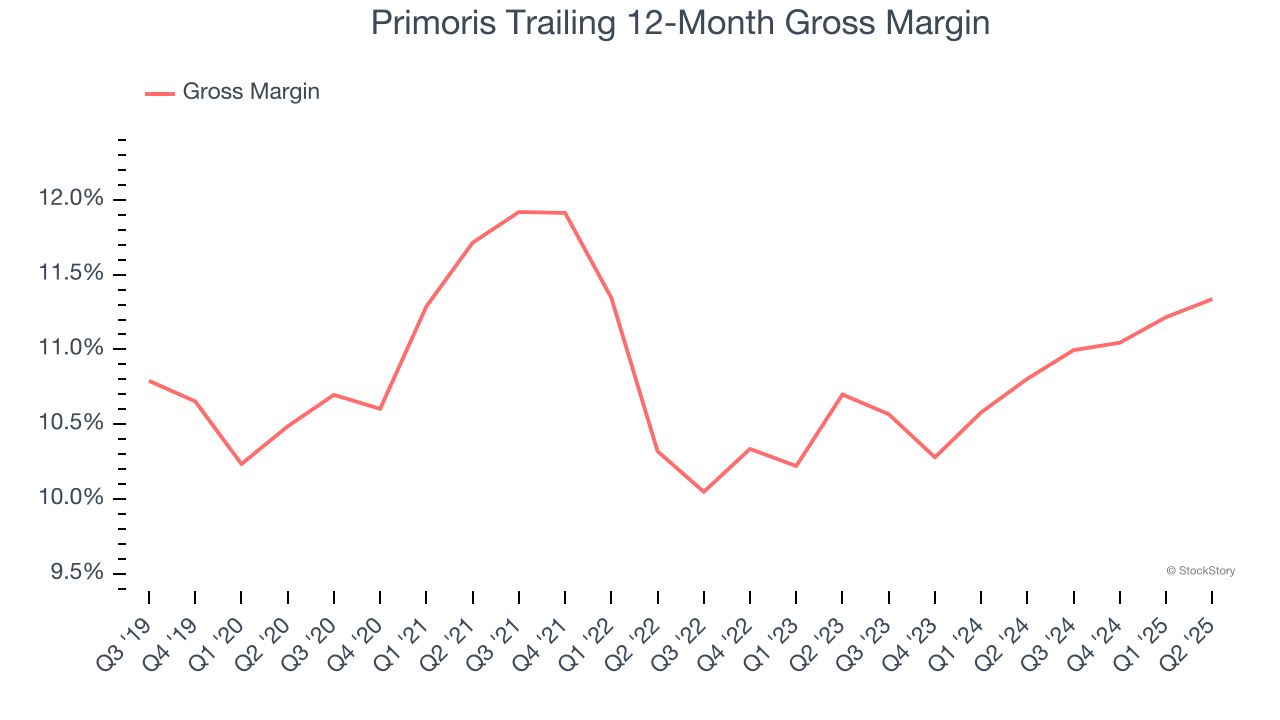

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Primoris has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 11% gross margin over the last five years. That means Primoris paid its suppliers a lot of money ($89.01 for every $100 in revenue) to run its business.

Final Judgment

Primoris’s positive characteristics outweigh the negatives, and with the recent surge, the stock trades at 24.5× forward P/E (or $113.50 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Primoris

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.