Wrapping up Q1 earnings, we look at the numbers and key takeaways for the consumer internet stocks, including Coinbase (NASDAQ:COIN) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 49 consumer internet stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer internet stocks have performed well with share prices up 11.5% on average since the latest earnings results.

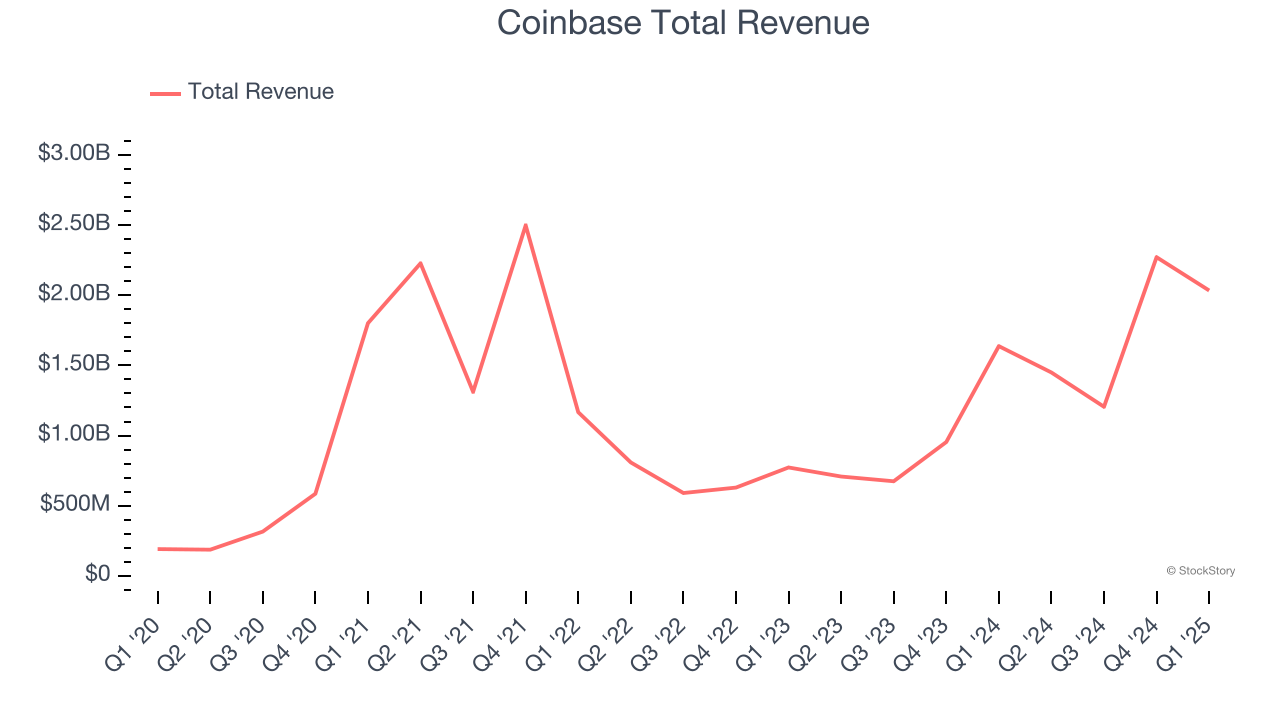

Coinbase (NASDAQ:COIN)

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

Coinbase reported revenues of $2.03 billion, up 24.2% year on year. This print fell short of analysts’ expectations by 3.6%. Overall, it was a slower quarter for the company with EBITDA in line with analysts’ estimates.

Interestingly, the stock is up 28.2% since reporting and currently trades at $264.80.

Is now the time to buy Coinbase? Access our full analysis of the earnings results here, it’s free.

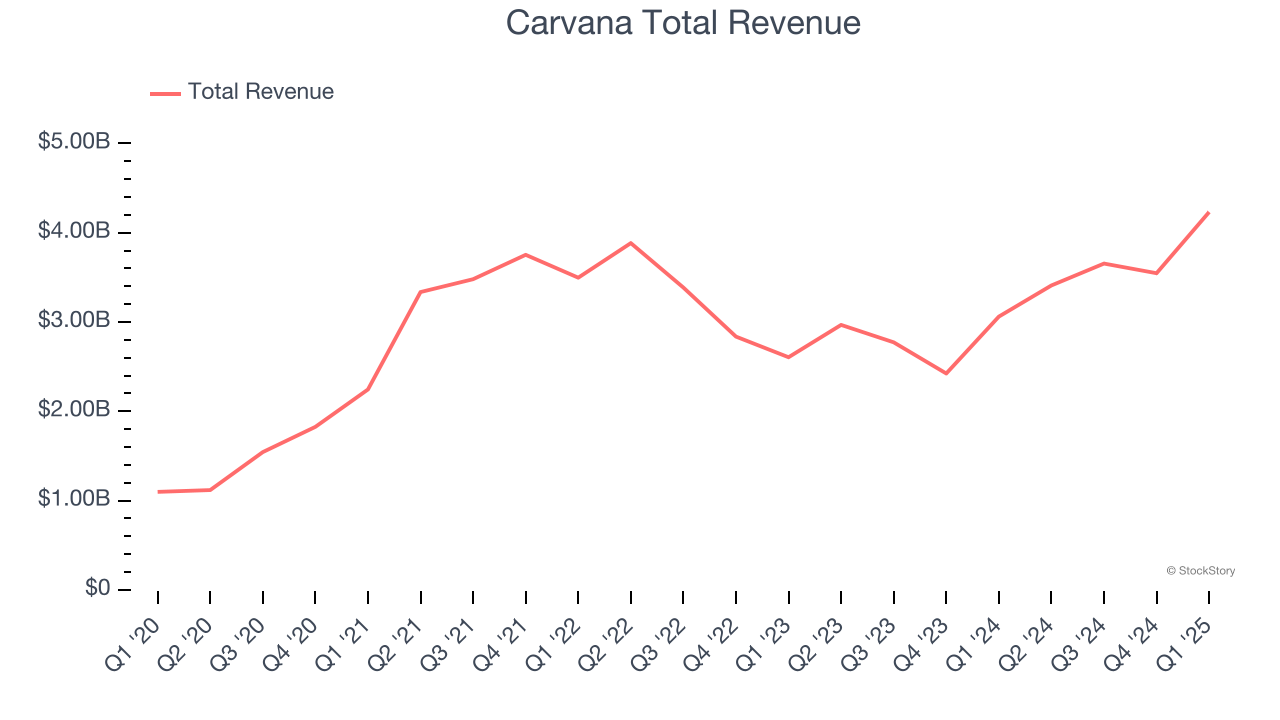

Best Q1: Carvana (NYSE:CVNA)

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.23 billion, up 38.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and impressive growth in its units.

The market seems happy with the results as the stock is up 18.4% since reporting. It currently trades at $306.20.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $160 million, up 11.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 25.3% since the results and currently trades at $5.45.

Read our full analysis of The RealReal’s results here.

Robinhood (NASDAQ:HOOD)

With a mission to democratize finance, Robinhood (NASDAQ:HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $927 million, up 50% year on year. This number beat analysts’ expectations by 1.2%. Taking a step back, it was a slower quarter as it logged a miss of analysts’ EBITDA estimates.

The company reported 25.8 million users, up 7.9% year on year. The stock is up 31.2% since reporting and currently trades at $64.50.

Read our full, actionable report on Robinhood here, it’s free.

Upwork (NASDAQ:UPWK)

Formed through the 2013 merger of Elance and oDesk, Upwork (NASDAQ:UPWK) is an online platform where businesses and independent professionals connect to get work done.

Upwork reported revenues of $192.7 million, flat year on year. This result surpassed analysts’ expectations by 2.2%. More broadly, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates but a decline in its customers.

The company reported 812,000 active customers, down 6.9% year on year. The stock is up 24.2% since reporting and currently trades at $16.53.

Read our full, actionable report on Upwork here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.