As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer internet industry, including Booking (NASDAQ:BKNG) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 49 consumer internet stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer internet stocks have performed well with share prices up 11.5% on average since the latest earnings results.

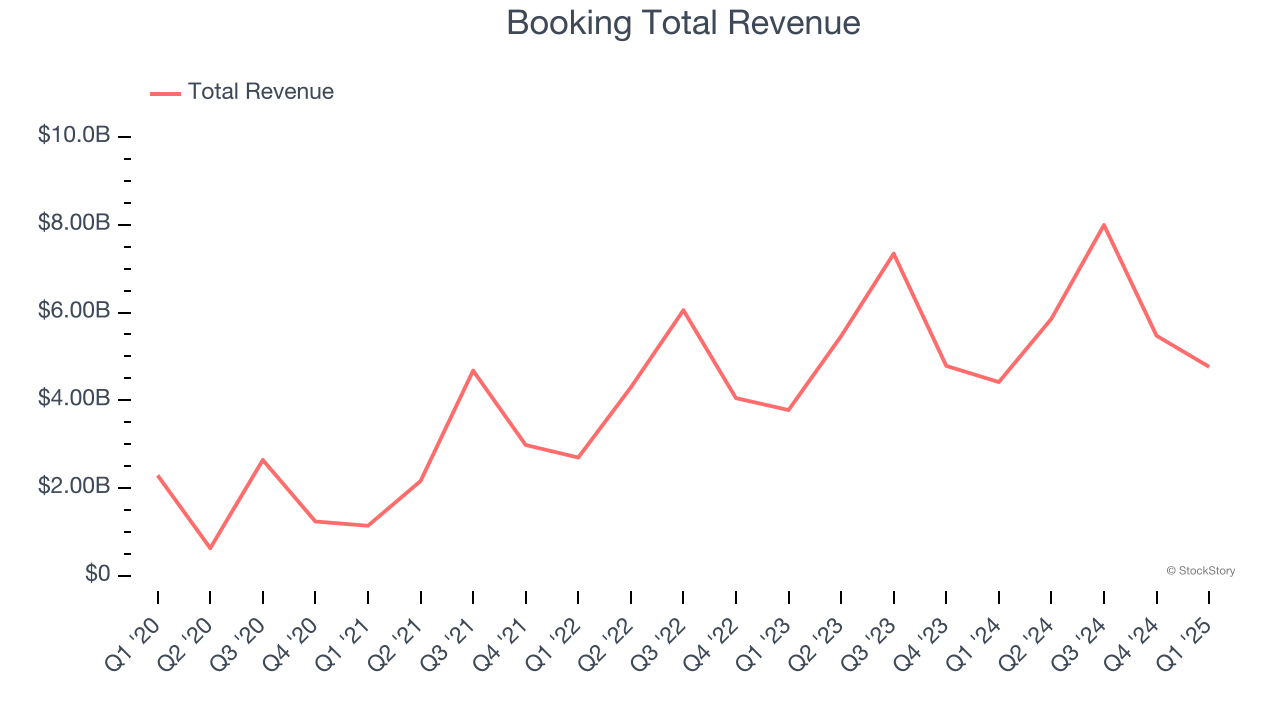

Booking (NASDAQ:BKNG)

Formerly known as The Priceline Group, Booking Holdings (NASDAQ:BKNG) is the world’s largest online travel agency.

Booking reported revenues of $4.76 billion, up 7.9% year on year. This print exceeded analysts’ expectations by 3.6%. Overall, it was a very strong quarter for the company with a decent beat of analysts’ EBITDA estimates and solid growth in its bookings.

Interestingly, the stock is up 9.6% since reporting and currently trades at $5,387.

We think Booking is a good business, but is it a buy today? Read our full report here, it’s free.

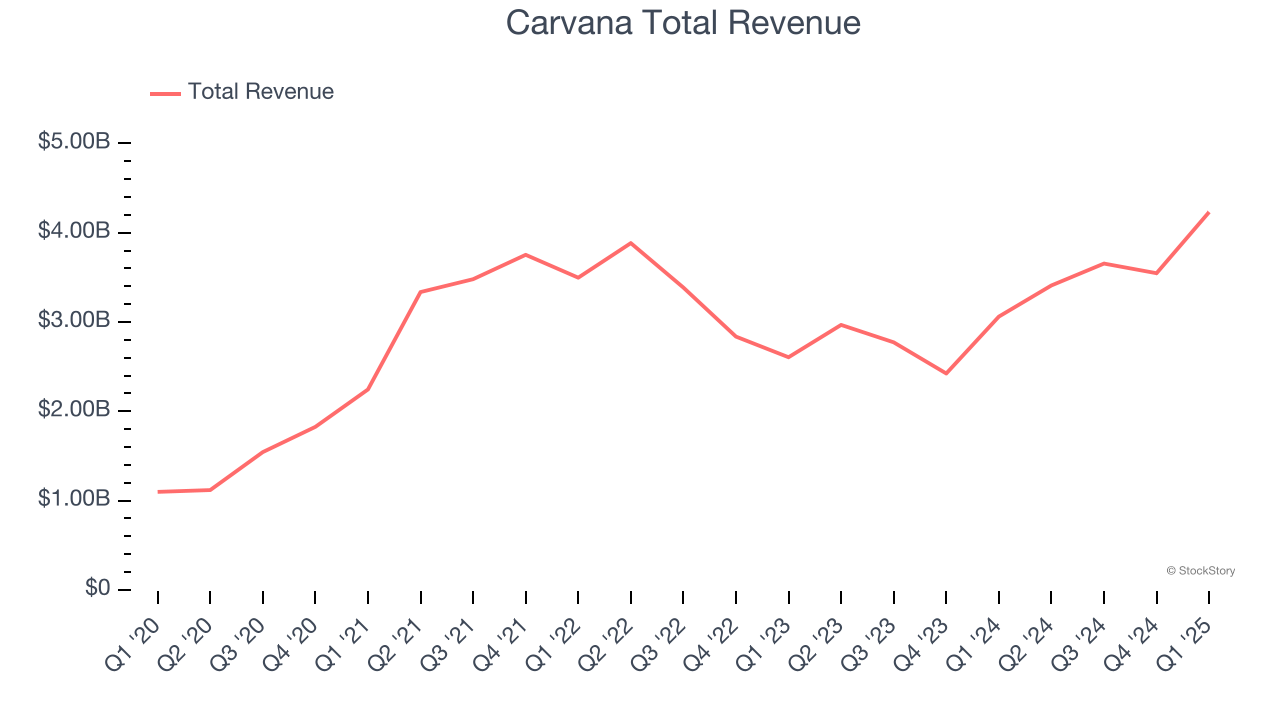

Best Q1: Carvana (NYSE:CVNA)

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.23 billion, up 38.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and impressive growth in its units.

The market seems happy with the results as the stock is up 18.4% since reporting. It currently trades at $306.20.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $160 million, up 11.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 25.3% since the results and currently trades at $5.45.

Read our full analysis of The RealReal’s results here.

Electronic Arts (NASDAQ:EA)

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ:EA) is one of the world’s largest video game publishers.

Electronic Arts reported revenues of $1.90 billion, up 6.5% year on year. This number beat analysts’ expectations by 7.6%. More broadly, it was a satisfactory quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations.

The stock is down 2.6% since reporting and currently trades at $150.54.

Read our full, actionable report on Electronic Arts here, it’s free.

Airbnb (NASDAQ:ABNB)

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $2.27 billion, up 6.1% year on year. This print topped analysts’ expectations by 0.6%. Taking a step back, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates but number of nights and experiences booked in line with analysts’ estimates.

The company reported 143.1 million nights booked, up 7.9% year on year. The stock is up 9.3% since reporting and currently trades at $135.56.

Read our full, actionable report on Airbnb here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.