Over the past six months, DexCom has been a great trade. While the S&P 500 was flat, the stock price has climbed by 15.6% to $87 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy DXCM? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is DXCM a Good Business?

Founded in 1999 and receiving its first FDA approval in 2006, DexCom (NASDAQ:DXCM) develops and sells continuous glucose monitoring systems that allow people with diabetes to track their blood sugar levels without repeated finger pricks.

1. Core Business Firing on All Cylinders

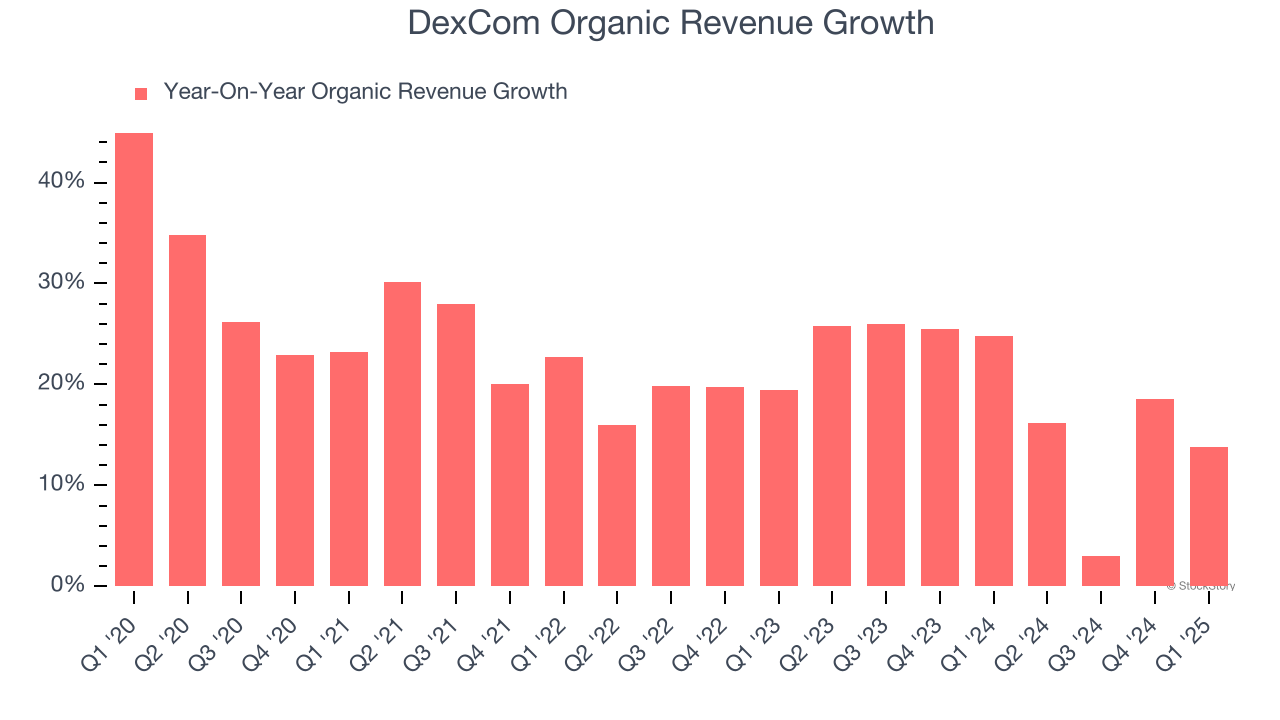

We can better understand Patient Monitoring companies by analyzing their organic revenue. This metric gives visibility into DexCom’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, DexCom’s organic revenue averaged 19.2% year-on-year growth. This performance was fantastic and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Outstanding Long-Term EPS Growth

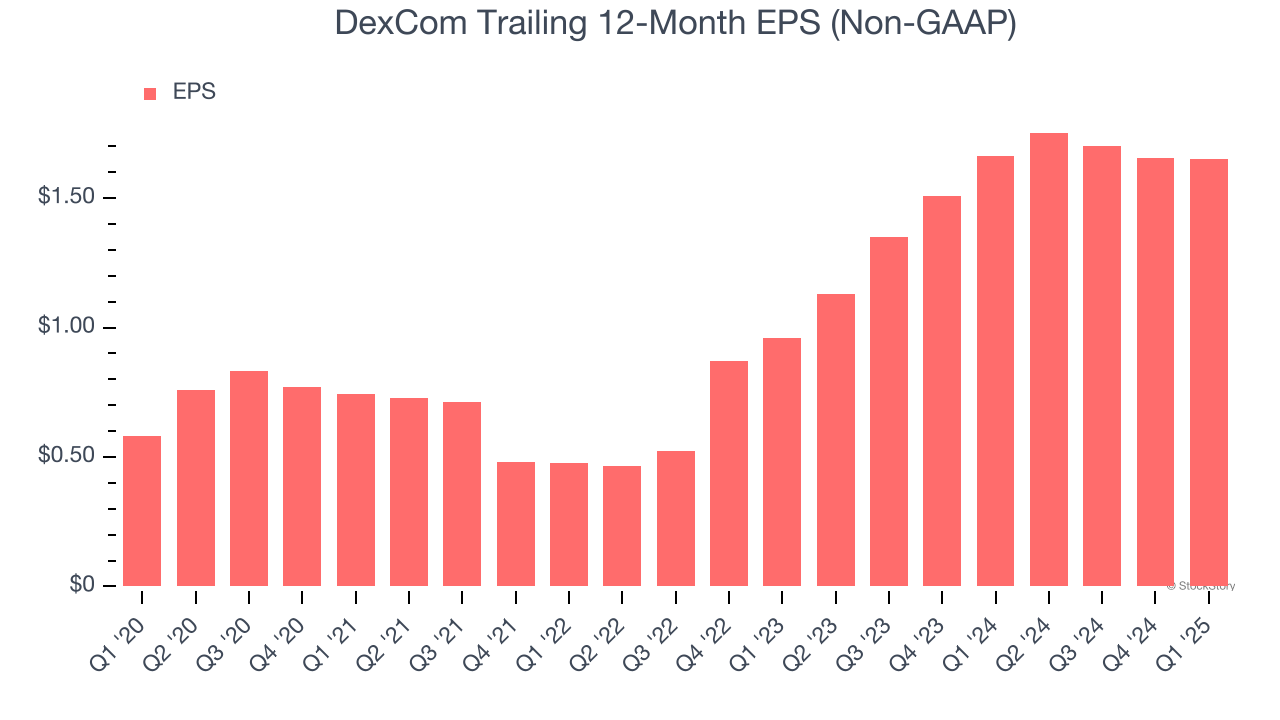

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

DexCom’s EPS grew at an astounding 23.2% compounded annual growth rate over the last five years, higher than its 21% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. Stellar ROIC Showcases Lucrative Growth Opportunities

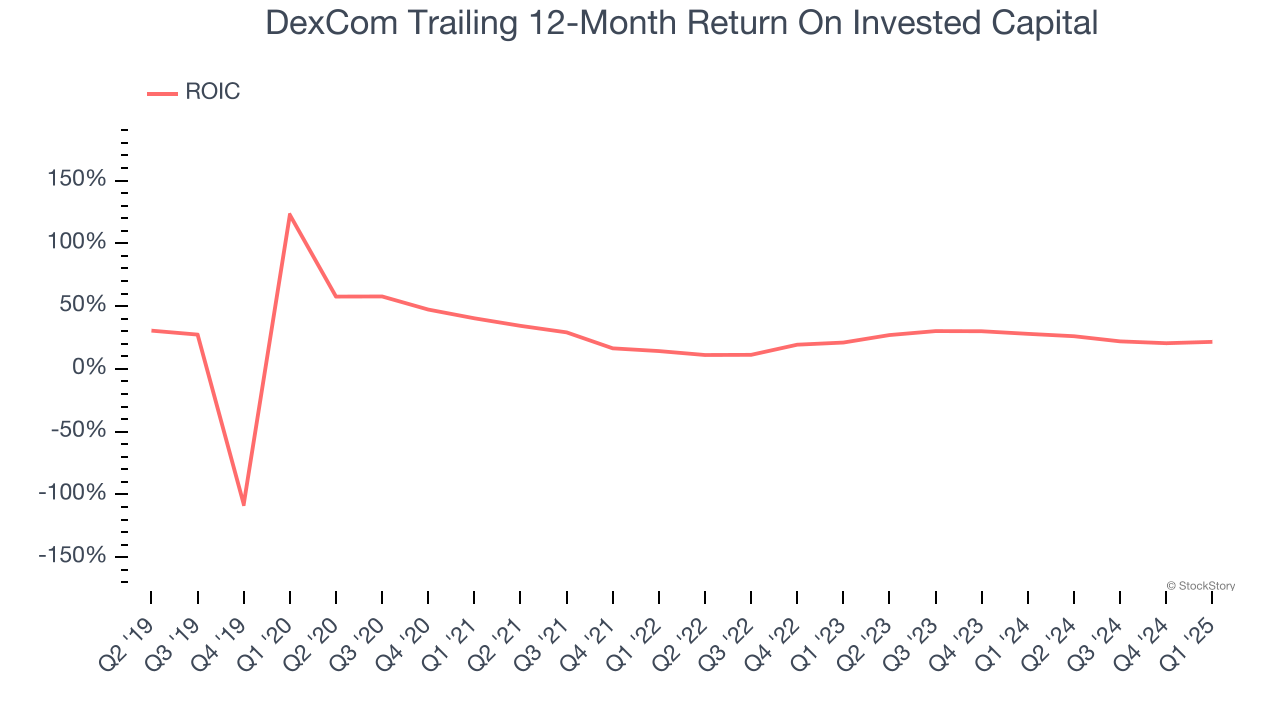

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

DexCom’s five-year average ROIC was 25%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why DexCom ranks highly on our list, and with its shares outperforming the market lately, the stock trades at 40.6× forward P/E (or $87 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.