Although Principal Financial Group (currently trading at $84.18 per share) has gained 17.5% over the last six months, it has trailed the S&P 500’s 33.2% return during that period. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Principal Financial Group, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Principal Financial Group Will Underperform?

We're sitting this one out for now. Here are three reasons we avoid PFG and a stock we'd rather own.

1. Revenue Spiraling Downwards

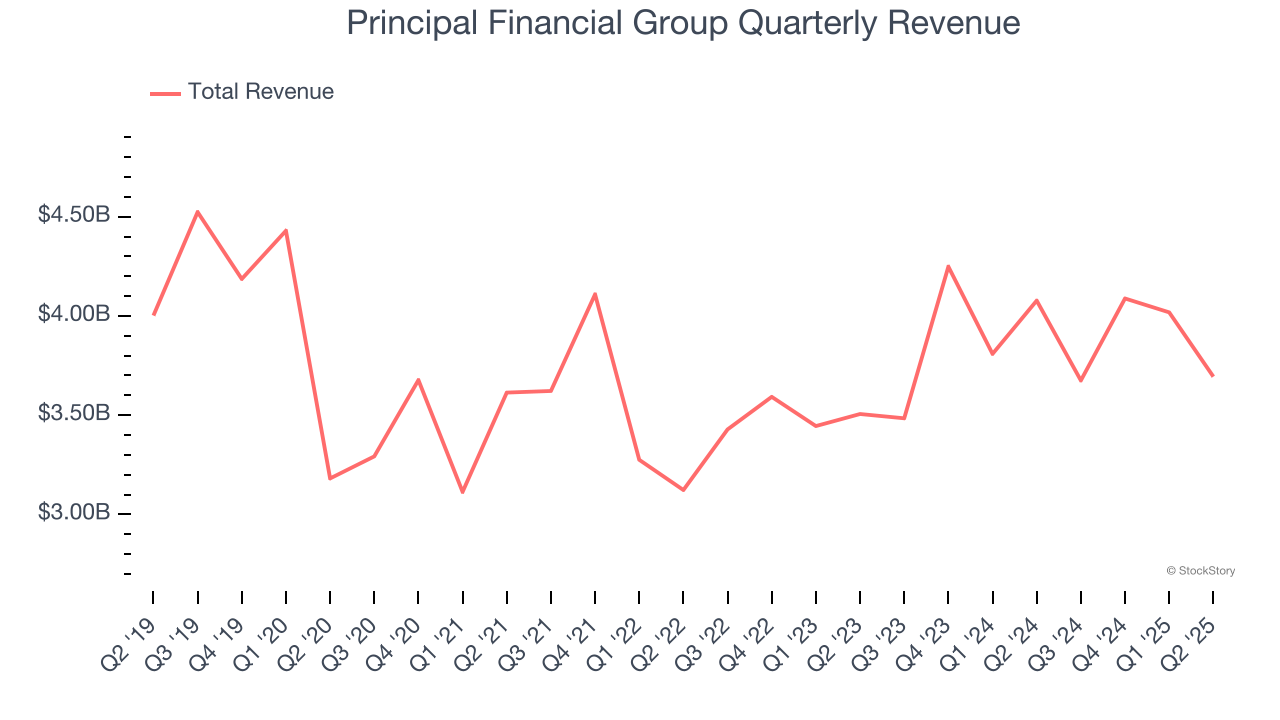

Insurers earn revenue three ways. The core insurance business itself, often called underwriting and represented in the income statement as premiums earned, is one way. Investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities is the second way. Fees from various sources such as policy administration, annuities, or other value-added services is the third.

Principal Financial Group’s demand was weak over the last five years as its revenue fell at a 1.1% annual rate. This was below our standards and signals it’s a low quality business.

2. Declining Net Premiums Earned Reflect Weakness

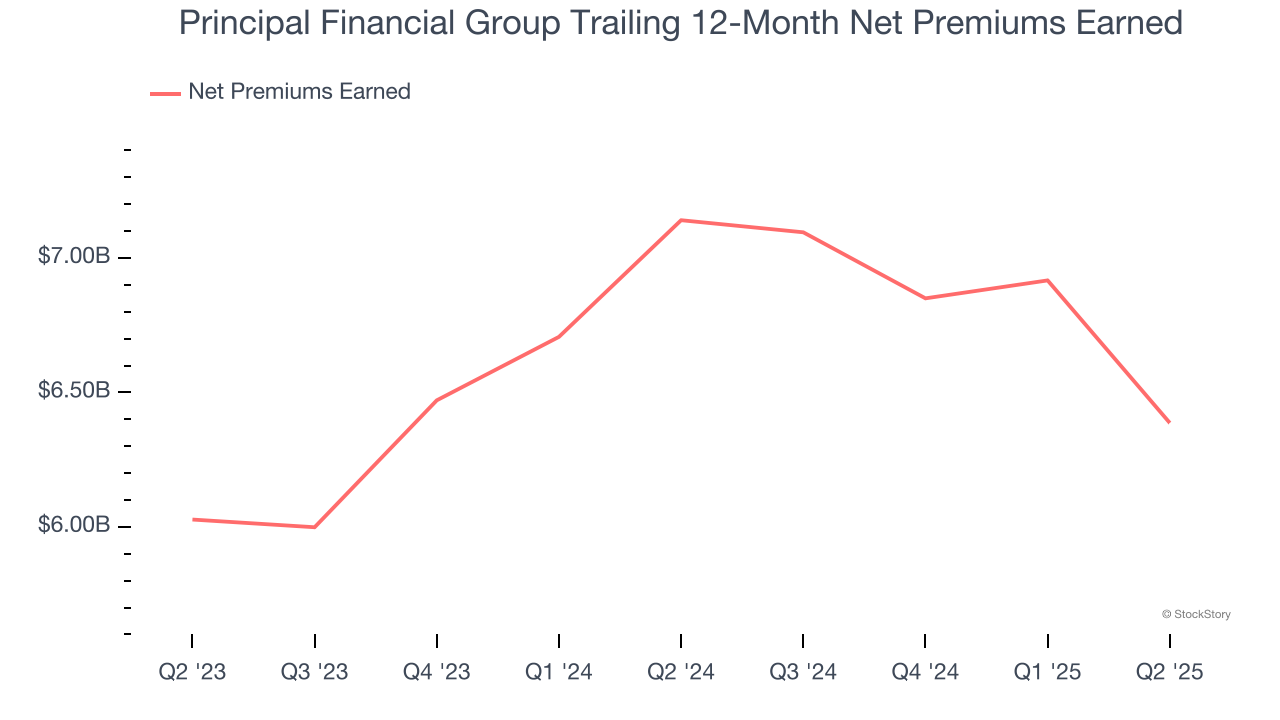

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Principal Financial Group’s net premiums earned has declined by 1.8% annually over the last five years, much worse than the broader insurance industry and in line with its total revenue.

3. Substandard BVPS Growth Indicates Limited Asset Expansion

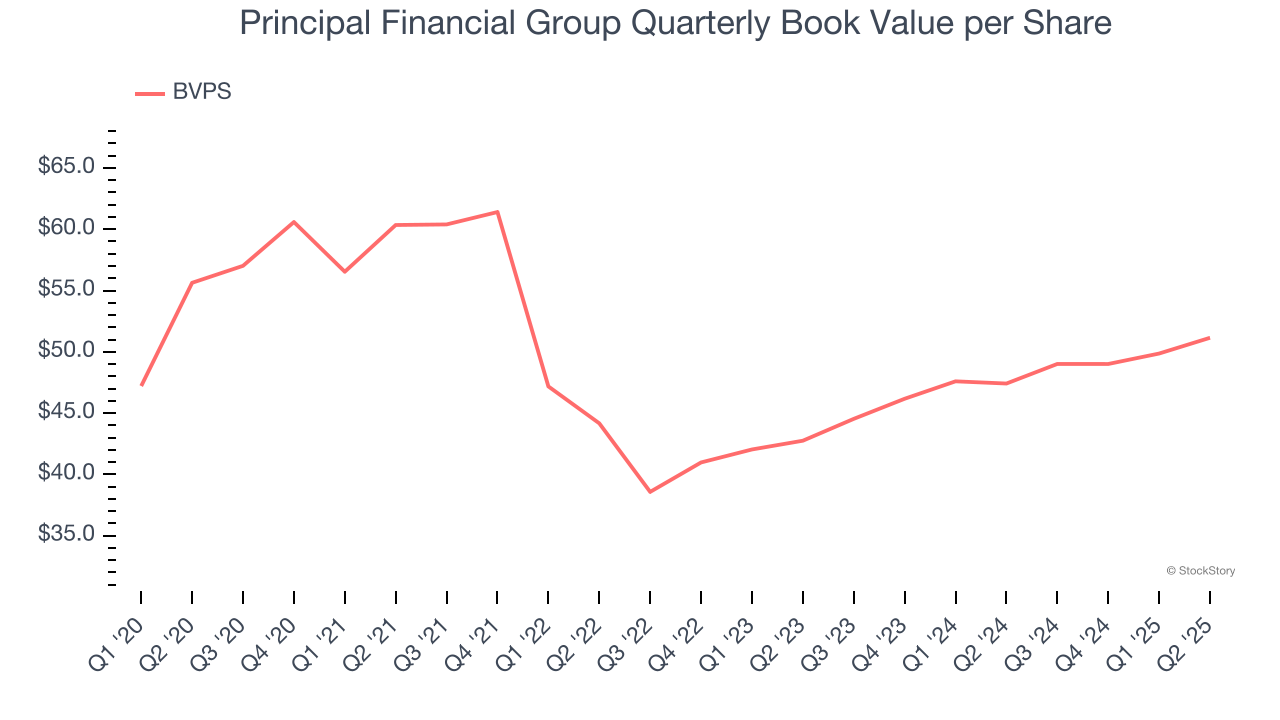

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

Disappointingly for investors, Principal Financial Group’s BVPS grew at a tepid 9.4% annual clip over the last two years.

Final Judgment

We see the value of companies helping consumers, but in the case of Principal Financial Group, we’re out. With its shares trailing the market in recent months, the stock trades at 1.6× forward P/B (or $84.18 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now. We’d recommend looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Principal Financial Group

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.