What a fantastic six months it’s been for BrightSpring Health Services. Shares of the company have skyrocketed 64.9%, hitting $28.50. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy BrightSpring Health Services, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is BrightSpring Health Services Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in BrightSpring Health Services. Here are three reasons you should be careful with BTSG and a stock we'd rather own.

1. Shrinking Adjusted Operating Margin

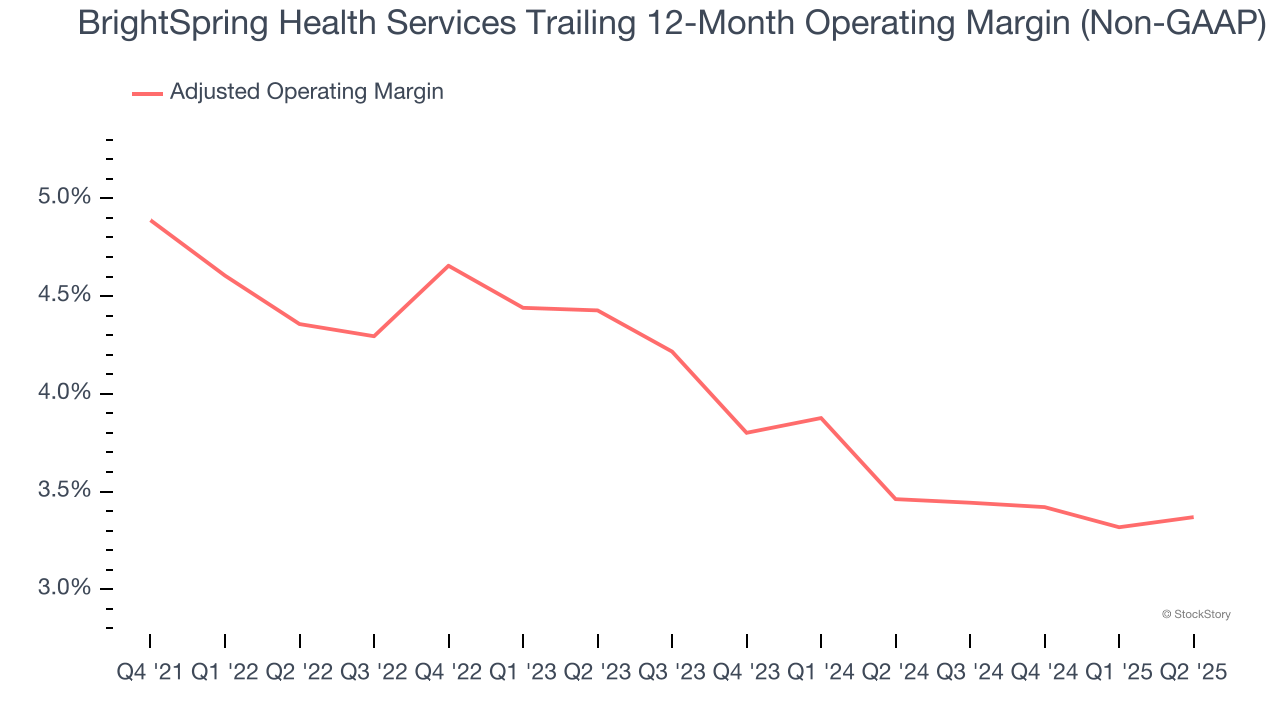

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Analyzing the trend in its profitability, BrightSpring Health Services’s adjusted operating margin decreased by 2.4 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. BrightSpring Health Services’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its adjusted operating margin for the trailing 12 months was 3.4%.

2. EPS Trending Down

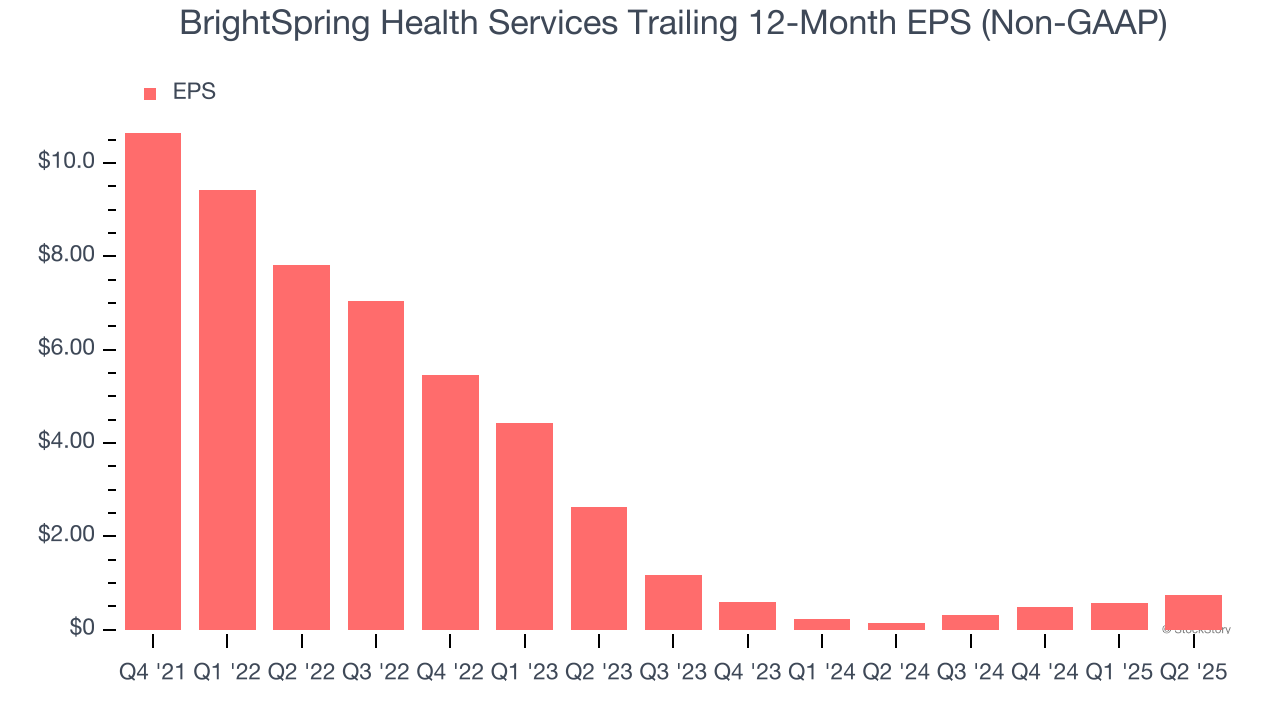

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

BrightSpring Health Services’s full-year EPS dropped significantly over the last four years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

3. Free Cash Flow Margin Dropping

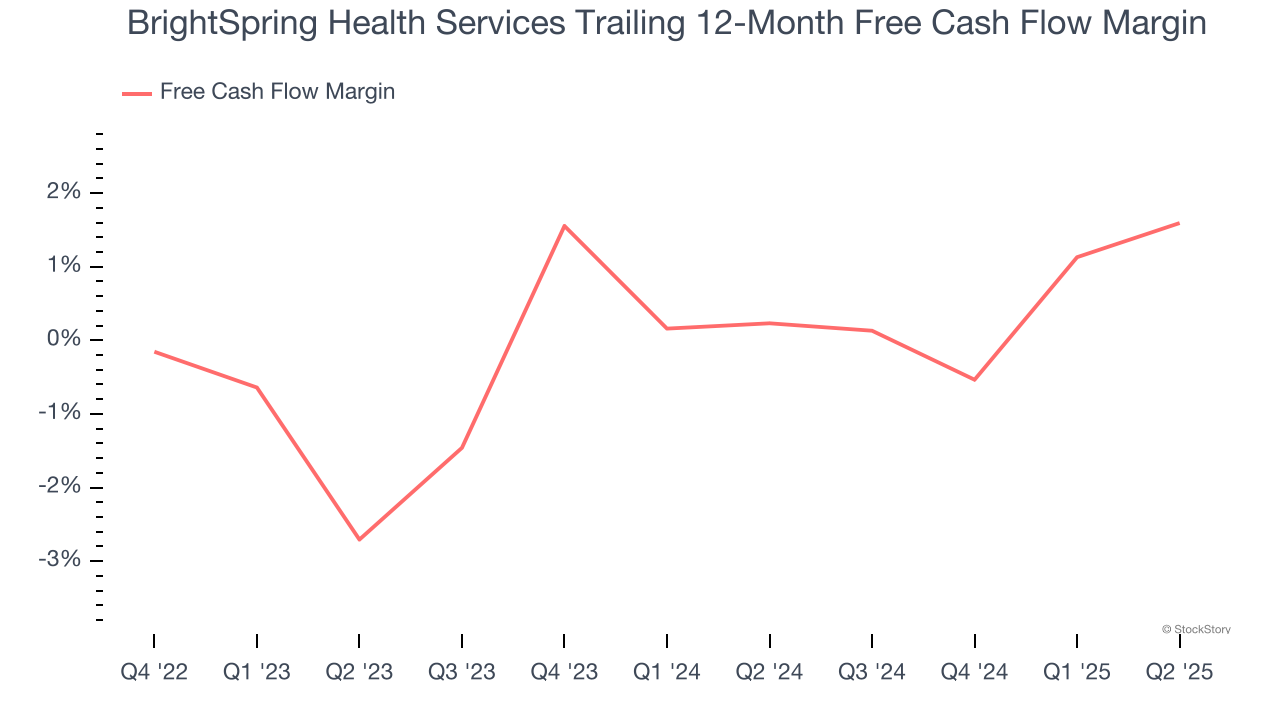

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, BrightSpring Health Services’s margin dropped by 5.3 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. BrightSpring Health Services’s free cash flow margin for the trailing 12 months was 1.6%.

Final Judgment

BrightSpring Health Services’s business quality ultimately falls short of our standards. After the recent rally, the stock trades at 29.4× forward P/E (or $28.50 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than BrightSpring Health Services

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.