Headquartered in Swords, Ireland, Trane Technologies plc (TT) is a global climate innovator, delivering sustainable HVAC solutions for commercial and residential buildings. The company also provides Thermo King transport refrigeration systems, supporting temperature-controlled logistics for perishable goods.

With a market capitalization of approximately $93.1 billion, Trane Technologies sits firmly within the “large-cap” bracket, reserved for companies valued above $10 billion.

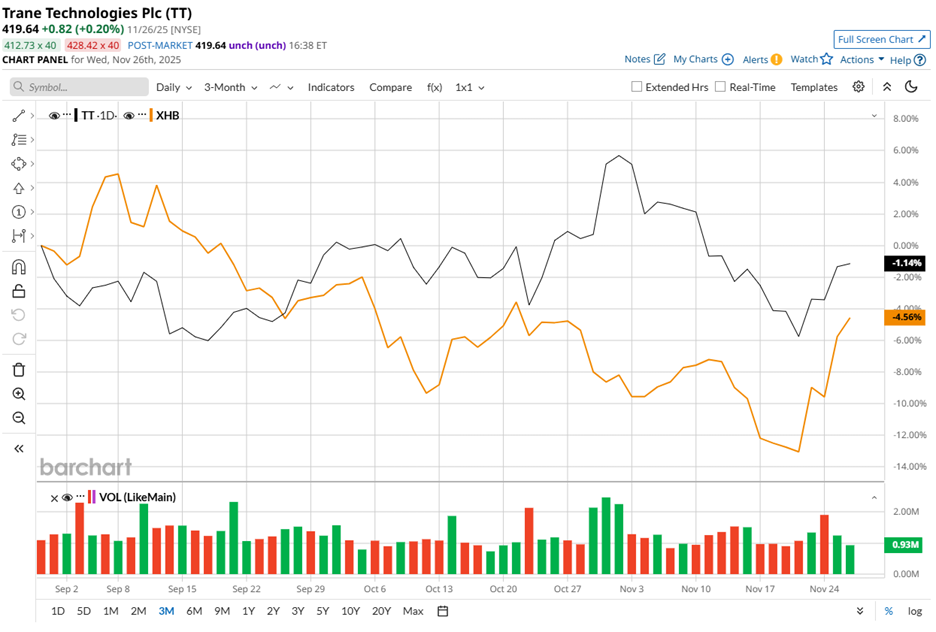

TT shares currently trade about 11.9% below their July high of $476.18. However, over the past three months, the stock has slipped nearly 1.5%, a milder pullback compared with the SPDR S&P Homebuilders ETF (XHB), which declined 5% in the same period.

The longer-term performance remains more encouraging. Over the past 52 weeks, TT posted a marginal gain, while XHB dropped 11.1%. Meanwhile, on a year-to-date (YTD) basis, TT stock has advanced 13.6%, outpacing XHB’s 4.5% rise.

The stock has been trading slightly below its 50-day moving average since this month, signaling short-term softness. However, it has held above its 200-day moving average since late April, aside from a brief dip, indicating that the broader uptrend remains intact.

TT stock strengthened further on Oct. 30 when its shares rose 4.4% intraday after the company reported Q3 2025 earnings. Adjusted EPS came in at $3.88, a 15.1% increase compared to the same period a year ago, surpassing analyst forecasts of $3.78. It was supported by operating margin expansion to 20.3% from 18.8% in the prior year’s period.

Revenue grew 5.6% annually to $5.74 billion, coming in just below the $5.79 billion consensus. However, the slight miss did little to unsettle investors, as management reaffirmed its full-year outlook. The company continues to project roughly 7% revenue growth for fiscal year 2025 and expects adjusted continuing EPS of $12.95 to $13.05.

Relative performance further strengthens the case. TT’s competitor, AAON, Inc. (AAON), remains sharply lower, down 33.6% over the past 52 weeks and 20.8% YTD, highlighting TT’s stronger execution through a softer industry backdrop.

Analysts remain constructive on TT’s outlook. Among 21 covering the stock, the consensus rating stands at “Moderate Buy,” and the average price target of $481.65 reflects a 14.8% premium to current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart