Headquartered in Wallingford, Connecticut, Amphenol Corporation (APH) designs, manufactures, and markets electrical, electronic, and fiber-optic connectors and systems across the globe.

With a market capitalization of about $169.8 billion, it sits comfortably in “large-cap” territory, supplying interconnect, cable, antenna, and sensor technologies to OEMs and service providers across industrial, automotive, aerospace, data, and communications markets.

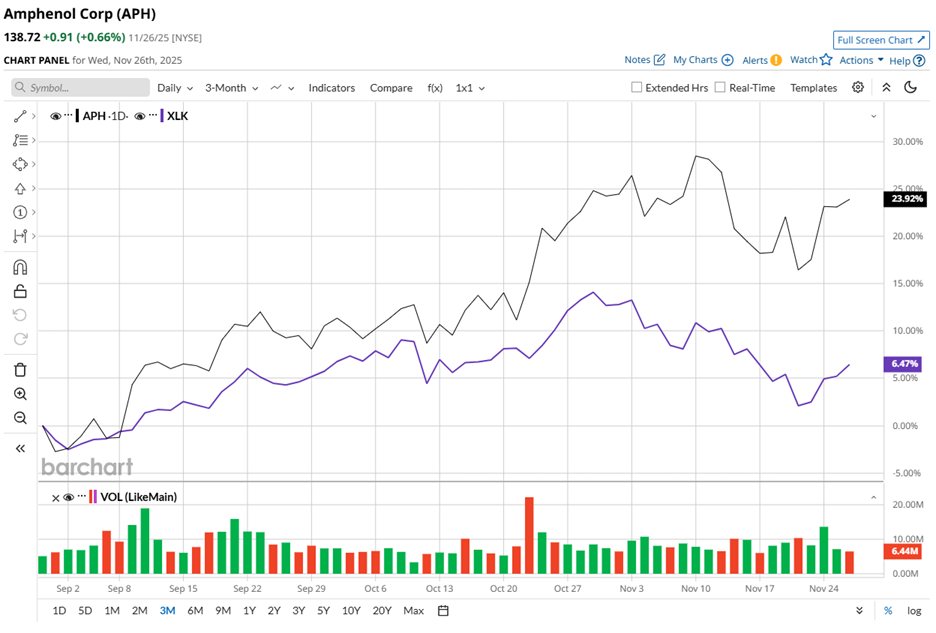

APH stock is currently trading roughly 3.9% below its November high of $144.37, yet the recent trend remains distinctly favorable. The stock has rallied nearly 26.2% over the past three months, far outstripping the Technology Select Sector SPDR Fund (XLK), which gained only 7.9% over the same period.

The longer-term performance paints an even stronger picture. APH has surged 89.4% over the past 52 weeks, far outpacing XLK’s 20.9% gain during the period. Year-to-date (YTD), the stock has jumped 99.7%, again beating XLK’s 20.9% rise in the same stretch.

Since May, APH has consistently traded above its 200-day moving average and 50-day moving average, with slight fluctuation, which reinforces that APH’s broader uptrend remains intact.

Fundamental performance has reinforced the trend. Shares pushed higher on Oct. 22, first rising 3.6% intraday, then adding another 5% the next day, after Amphenol delivered a strong Q3 2025 earnings report.

Revenue climbed 53.4% year over year (YoY) to $6.19 billion, comfortably ahead of the $5.48 billion consensus, supported by broad demand for high-technology interconnect solutions, particularly across IT datacom and communication networks. Adjusted EPS rose 86% to $0.93, surpassing the $0.79 Street’s estimate. Plus, management expects the strength to continue. For fiscal Q4 2025, they forecast sales between $6 billion and $6.1 billion, representing 39% to 41% growth over last year, with adjusted diluted EPS projected between $0.89 and $0.91, up 62% to 65%.

For the full fiscal year 2025, Amphenol anticipates sales to be between $22.66 billion and $22.76 billion, and adjusted diluted EPS of $3.26 to $3.28 range, annual increases of 49% to 50% and 72% to 74%, respectively.

Relative performance strengthens the case even more. Corning Incorporated (GLW), Amphenol’s rival, climbed 74.2% over the past 52 weeks and 75.9% on a YTD basis. Yet even the strong gains fall short of APH’s significantly superior performance.

Given the price strength, sector-leading returns, and firm fundamentals, analysts remain constructive. Among 17 covering the stock, the consensus rating is “Strong Buy,” and the average price target of $149.56 indicates upside potential of 7.8% from current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart